The best coverage, reimagined

Travel insurance on subscription

In cooperation with

![]()

- Take cover out online

- Pay monthly

- 24/7 hotline

- Worldwide protection

Package

Personal

liability

- Cancellation &

SOS assistanceYou are unable to start your booked trip or have to cancel it because of illness, an accident or flooding. Or you are dependent on emergency assistance during your holidays.

Learn more - Luggage

Your luggage does not arrive, is damaged or is stolen.

Learn more - Medical and

hospital costsYou are dependent on medical assistance while travelling abroad.

Learn more - Excess guarantee for

hire vehiclesIf your hire vehicle has to be towed away, for example, this cover means you do not pay any excess.

Learn more - Flight

You miss your connecting flight through no fault of your own, the flight is cancelled due to the airline's insolvency or you suffer injuries due to an air accident.

Learn more - Breakdown

assistanceMotorbikes, cars and motorhomes are insured if you break down while travelling.

Learn more

Choose package

Travel

S

Ideal for travellers who only need the essentials and want to enjoy their adventures without complications.

Personal liability

-

-

-

-

-

-

from 8.50 per month

Start date: 06.01.25

Adress: Zurich

People: 1 adult

Travel

M

Perfect for holidaymakers looking for a balanced mix of protection and convenience for worry-free travel.

Personal liability

-

-

-

-

-

-

from 21.65 per month

Start date: 06.01.25

Adress: Zurich

People: 1 adult

Travel

L

Ideal for those who want to be protected against all eventualities so that they can enjoy their trip to the full.

Personal liability

-

-

-

-

-

-

from 29.95 per month

Start date: 06.01.25

Adress: Zurich

People: 1 adult

Can’t find the right subscription?

Then tailor-make your own.

Details of cover

What does travel insurance cover?

The basic travel insurance package covers you in the event of cancellation or an emergency during your trip. With the additional options, you can also insure medical costs, your luggage and your flight, among other things.

Cancellation & SOS assistance

What is covered

Cancellation costs

You are unable to start your booked trip or have to cancel it because of illness, an accident or flooding. Or you are dependent on emergency assistance during your holidays.

Example:

You fall ill with severe pneumonia while travelling and have to go to hospital. You’re unable to continue your journey.

SOS assistance

You need to call an ambulance during your holiday because of an emergency.

Example:

You’ve had an accident on a scooter while on holiday and need to be taken to hospital by ambulance.

Volcanoes and natural disasters

A natural disaster or volcanic eruption makes it impossible for you to continue your journey.

Example:

You wanted to travel to Egypt, but a volcano erupts in Italy before your departure and your flight is cancelled.

What is not covered

Cancellation costs

Pre-existing or foreseeable events at the time the insurance was taken out.

Example:

You want to drive to the airport in your car, but you break down on the way and miss your flight. The breakdown occurred because you failed to maintain your vehicle properly.

SOS assistance

Events that were foreseeable before departure or were caused by inadequate vehicle maintenance.

Example:

You were already receiving medical treatment when you took out the insurance and your trip extension is a consequence of this.

Volcanoes and natural disasters

Events that had already taken place before you took out the insurance or booked your trip.

Example:

A location has been affected by flooding, but you book a trip there anyway.

How we help you

Cancellation costs

In the event of a claim, the insurance will cover the cancellation costs up to the insured amount.

If an insured person is unable to start their trip, the insurance will cover the costs of rebooking or cancellation.

If a person has to interrupt their trip due to an insured event, the insurance will cover the additional costs of the unscheduled return journey.

SOS assistance

In the event of a claim, the insurance will cover search and rescue costs, transport to the nearest hospital, the costs for a temporary return and the additional costs of an unscheduled return or repatriation in the event of death.

Volcanoes and natural disasters

The insurance will cover your losses if you have to cancel your trip or are unable to start it due to a natural disaster. The maximum sum insured is CHF 2,000.–.

Luggage

What is covered

Your luggage does not arrive, is damaged or is stolen.

Example:

You fly off on holiday but your luggage arrives a day late, which means you have to buy essential items at your holiday destination.

What is not covered

The insurance will not pay out if any of the following applies: you have acted with gross negligence; the damage occurred as a result of wear and tear; you failed to pack the items in accordance with their value; you did not contact the police within 24 hours.

Example:

You are carrying your Rolex watch in your suitcase and it is stolen.

How we help you

In the case of write-off or definitive lost, the insurance will cover the current value of the insured items up to the insured amount or, in the event of damage, will pay the costs of repair.

Medical and hospital costs

What is covered

You need medical assistance while travelling abroad.

Example:

You’ve contracted malaria and need to go to hospital. Medical and hospital costs in excess of the maximum insured share of your health insurance are covered.

What is not covered

You already had symptoms when you took out the insurance. Or you have a check-up while travelling.

Example:

You were already having symptoms of an illness when you took out the travel insurance shortly before your holiday, as a result of which you have to consult a doctor during your holiday abroad.

How we help you

In the event of a claim, the insurance will pay up to CHF 100,000 for medical and hospital costs. This is after the cover provided by health insurance, accident insurance and supplementary insurance has been honoured.

Excess guarantee for hire vehicles

What is covered

The insurance will cover the vehicle hired by the insured person, such as a car or motorbike that they have hired.

Example:

You’ve hired a car for a road trip, had an accident and the car is damaged to the tune of CHF 5,000.–. You have an excess of CHF 2,000.–. This is covered by the insurance.

What is not covered

The insurance does not cover damage to hire vehicles that are not registered or if damage occurs somewhere other than the public highway.

Example:

You drive off the official roads for fun, as you want to enjoy an off-road experience. The car is damaged in the process.

How we help you

The insurance will cover damage up to the amount of the excess, subject to a maximum of CHF 10,000 per hire contract.

Flight

What is covered

Flight delay

You miss your connecting flight due to the first flight being delayed by at least three hours.

Example:

The pilot arrives late, which is why your flight is not able to take off until after a three-hour delay and can’t make up the time. You therefore miss your connecting flight.

Protection in the event of airline and service provider insolvency

Your travel provider has gone bankrupt and your trip will not go ahead.

Example:

You’ve booked a cruise, but then the shipping company files for bankruptcy and your trip does not go ahead.

Air accident

Accidents that you suffer as a passenger when travelling in an aircraft.

Example:

You suffer serious injuries during the flight due to turbulence, resulting in (partial) disability.

What is not covered

Flight delay

The delay occurred through your own fault.

Example:

You booked your connecting flight yourself and allowed just 10 minutes for the changeover, and you missed your connection as a result.

Protection in the event of airline and service provider insolvency

The bankruptcy of the travel provider was foreseeable.

Example:

The travel provider announced its initial insolvency before you made your booking.

Air accident

You were partly responsible for the incident that led to the accident.

Example:

You smuggled toxic substances onto the aircraft.

How we help you

Flight delay

The insurance will cover costs up to a maximum of CHF 1,000.– for continuation of the journey if the flight is delayed by at least three hours. The insurance will make this payment after the responsible airline has paid its share to cover the additional costs.

Protection in the event of airline and service provider insolvency

The insurance will cover the costs of rebooking or transferring the booking to another provider.

Air accident

The insurance will cover the medical costs incurred as a result of the accident, after the health insurance or accident insurance has paid its share.

Breakdown assistance

What is covered

Motorbikes, cars, motorhomes and trailers are insured if you break down while travelling.

Example:

You’re on a road trip through Europe on your motorbike, but your motorbike breaks down with the result that you can no longer continue your journey and have to call a recovery service.

What is not covered

The following are not covered: hire vehicles; damage to the vehicle that existed before the start of the journey; vehicles that have been inadequately maintained.

Example:

You’ve hired a car in Spain and have am accident while parking, resulting in the car needing to be towed away and repaired.

How we help you

The insurance will cover the costs of recovery, towing and repair of the vehicle up to CHF 400.–, taking into account the current value of the vehicle.

The benefits for you

Take out policy easily online

You can take out the insurance subscription easily online in a few clicks. No paperwork or complicated consultations.

Monthly payments

Your insurance subscriptions can be conveniently paid for through your Swisscom bill as usual, in just the same way as your other Swisscom subscriptions.

24/7 hotline

You can reach the insurance hotline 24/7 from anywhere in the world.

Worldwide protection

Your insurance is valid in Switzerland and worldwide.

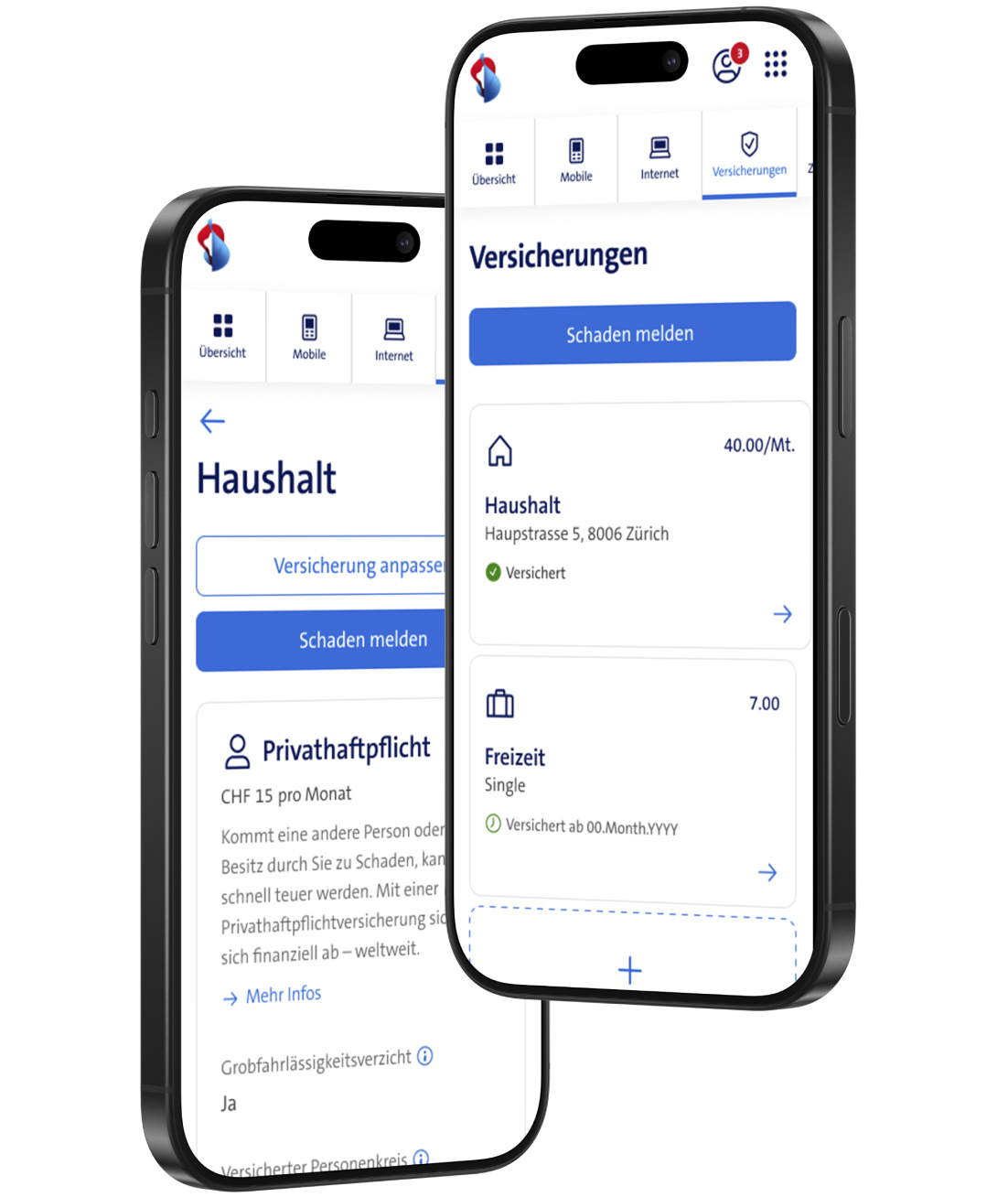

Everything in the My Swisscom app

You will find everything relating to your insurance subscription in the My Swisscom app.

| | Policy, documents, bills |

| | Report claims |

| | Change cover and options |

| |

Cancellation template: We’ll help you switch to us.

Frequently asked questions

When is it worth getting travel insurance?

Whether it's a city break in Paris, a beach holiday in Ibiza or a three-month trip through Central America: Travel insurance is worthwhile for holidays as well as for longer trips.

With travel insurance, you are on the safe side if something unforeseen happens, such as an illness, accident or another misfortune. Natural hazards such as flooding can also upset your plans. If you are unable to travel or have to cancel your trip, at least your costs are covered. With additional options, you can also get cover for your luggage, medical expenses, air accidents and much more.

Where is the travel insurance valid?

The travel insurance is valid worldwide. Whether you want to travel in Switzerland, book a trip to Southeast Asia or discover the rugged nature of Alaska – with travel insurance you are covered worldwide.

When is the travel insurance valid from?

Your travel insurance is valid from the selected start date. It cannot be concluded retroactively, however, if the event has already occurred.

Can travel insurance be canceled monthly?

After a minimum term of 1 year, you can cancel your travel insurance cover on a monthly basis. For one-off trips or shorter cover, we recommend our leisure insurance.

Does travel insurance also equate to health insurance abroad?

The supplementary option for "Medical and hospital costs" is an ideal addition to your health and accident insurance. This covers medical expenses abroad that are not covered by your health or accident insurance, for example because treatment abroad, such as in the USA, is much more expensive than in Switzerland.

Is my luggage also covered?

With the additional "Luggage" option, your luggage is insured in the event that it is stolen, damaged, destroyed or lost. You also benefit in the event of late delivery, so at least costs of up to CHF 1,000.– are covered for purchase of the most essential items.

How high is the travel insurance excess?

The travel insurance has no excess.

How do you claim on Swisscom leisure insurance?

You can report a claim online with ERV:

Online: www.erv.ch/schaden(opens in new tab)

Telephone: +41 58 275 27 27

E-Mail: schaden@erv.ch

We would be happy to advise you personally

If you have any questions, please contact the Swisscom sure Customer Care team.

Free: Lines are open Monday to Friday 8 am to 5 pm.

Make a claim

If you need to make a claim, you can contact ERV’s claims service directly.

Online: www.erv.ch/schaden(opens in new tab)

Telephone: +41 58 275 27 27

E-Mail: schaden@erv.ch