Switch-On

Rental guarantee insurance

Forget about expensive security deposits – use our easy alternative instead. Rental guarantee insurance gives you financial flexibility while offering your landlord financial security.

from 10.50 per month

What is Swisscom sure?

Swisscom sure provides flexible insurance tailored to your wants and needs.

Rental guarantee insurance is offered in collaboration with our partner, AXA Insurance Ltd.

What does rental guarantee insurance cover?

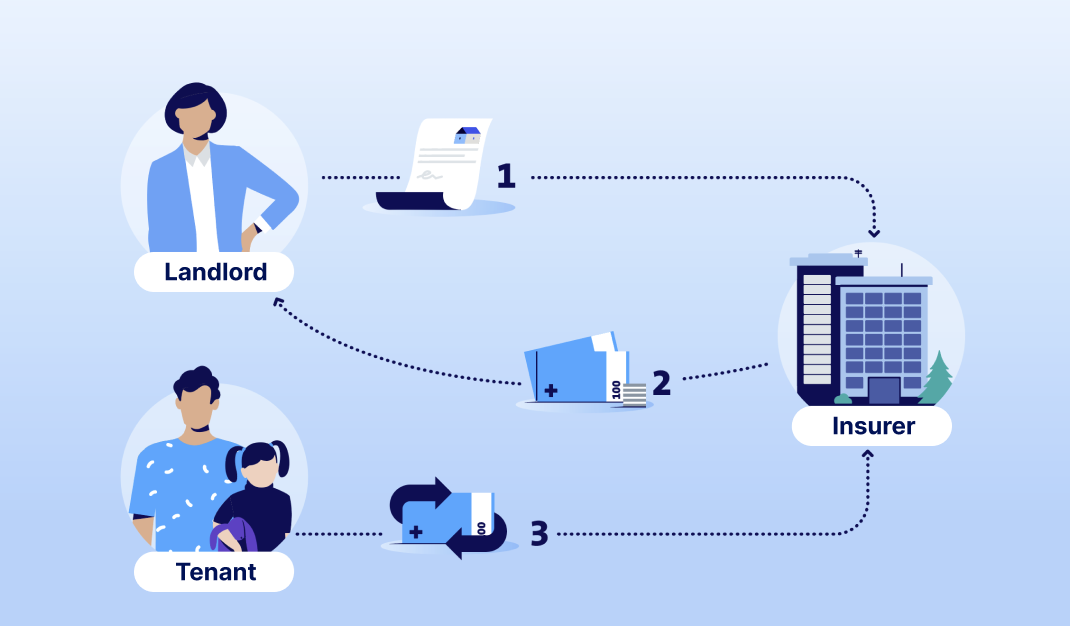

Rental guarantee insurance is a surety that gives you financial flexibility, while at the same time offering your landlord the same level of security as with a security deposit. You pay a monthly premium for this surety.

Rental guarantee insurance explained: If you damage your rental apartment or fail to pay your rent, this insurance will reimburse your landlord. You will then have to repay this amount later.

All advantages at a glance

Greater financial freedom

Use your money for what's important – new furnishings for your place or other things you really want.

Landlords are happy

Landlords appreciate rental guarantee insurance because it provides them with immediate security.

Monthly payments

Pay it monthly together with your Swisscom bill – no annual payments or installment fee.

Short notice period

Cancel when you wish to. No lengthy contract terms.

Free advisory service

Our team is ready to help with any questions or issues you may have - free of charge.

Rental guarantee insurance

From 10.50 per month

General Insurance Conditions

Here's how it works

Make your dream apartment come true

Marcel and Aurora have just been approved for an apartment. But the security deposit amounts to three months’ rent. This is too much for them.

The couple would rather spend their money on a car and new furniture.

So Marcel and Aurora decide to take out rental guarantee insurance through Swisscom sure.

Their landlord receives a surety bond certificate. He appreciates how little paperwork is involved.

Marcel and Aurora can now keep their money. They can start this new phase of their life without any stress.

Any questions?

We will be happy to assist.

What is rental guarantee insurance?

Security deposit or rental guarantee insurance: What’s the difference?

Are my premiums used to pay off the security deposit?

What are the requirements for taking out rental guarantee insurance?

What data does Swisscom use, how and for what purpose?

Give us a call.

Unable to find the answer you were looking for or in need of additional help?

The Customer Care Team at Swisscom sure will be happy to help you.

Lines are open Monday to Friday 8 am to 5 pm.

Call for free

We offer more

Everything you need to know about Swisscom sure insurance services.

Cancellation costs and assistance in an emergency. For holidays or in your free time.

If your mobile is dropped or suffers a broken screen or water damage, Easy Protection covers you against the financial consequences of a repair.