The best coverage, reimagined

Travel insurance on subscription

In cooperation with

![]()

- Take cover out online

- Pay monthly

- 24/7 hotline

- Worldwide protection

Package

Personal

liability

- Cancellation &

SOS assistanceYou are unable to start your booked trip or have to cancel it because of illness, an accident or flooding. Or you are dependent on emergency assistance during your holidays.

Learn more - Luggage

Your luggage does not arrive, is damaged or is stolen.

Learn more - Medical and

hospital costsYou are dependent on medical assistance while travelling abroad.

Learn more - Excess guarantee for

hire vehiclesIf your hire vehicle has to be towed away, for example, this cover means you do not pay any excess.

Learn more - Flight

You miss your connecting flight through no fault of your own, the flight is cancelled due to the airline's insolvency or you suffer injuries due to an air accident.

Learn more - Breakdown

assistanceMotorbikes, cars and motorhomes are insured if you break down while travelling.

Learn more

Choose package

Travel

S

Ideal for travellers who only need the essentials and want to enjoy their adventures without complications.

Personal liability

-

-

-

-

-

-

from 8.50 per month

Start date: 06.01.25

Adress: Zurich

People: 1 adult

Travel

M

Perfect for holidaymakers looking for a balanced mix of protection and convenience for worry-free travel.

Personal liability

-

-

-

-

-

-

from 21.65 per month

Start date: 06.01.25

Adress: Zurich

People: 1 adult

Travel

L

Ideal for those who want to be protected against all eventualities so that they can enjoy their trip to the full.

Personal liability

-

-

-

-

-

-

from 29.95 per month

Start date: 06.01.25

Adress: Zurich

People: 1 adult

Can’t find the right subscription?

Then tailor-make your own.

Details of cover

What does travel insurance cover?

The basic travel insurance package covers you in the event of cancellation or an emergency during your trip. With the additional options, you can also insure medical costs, your luggage and your flight, among other things.

Cancellation & SOS assistance

Luggage

Medical and hospital costs

Excess guarantee for hire vehicles

Flight

Breakdown assistance

The benefits for you

Take out policy easily online

You can take out the insurance subscription easily online in a few clicks. No paperwork or complicated consultations.

Monthly payments

Your insurance subscriptions can be conveniently paid for through your Swisscom bill as usual, in just the same way as your other Swisscom subscriptions.

24/7 hotline

You can reach the insurance hotline 24/7 from anywhere in the world.

Worldwide protection

Your insurance is valid in Switzerland and worldwide.

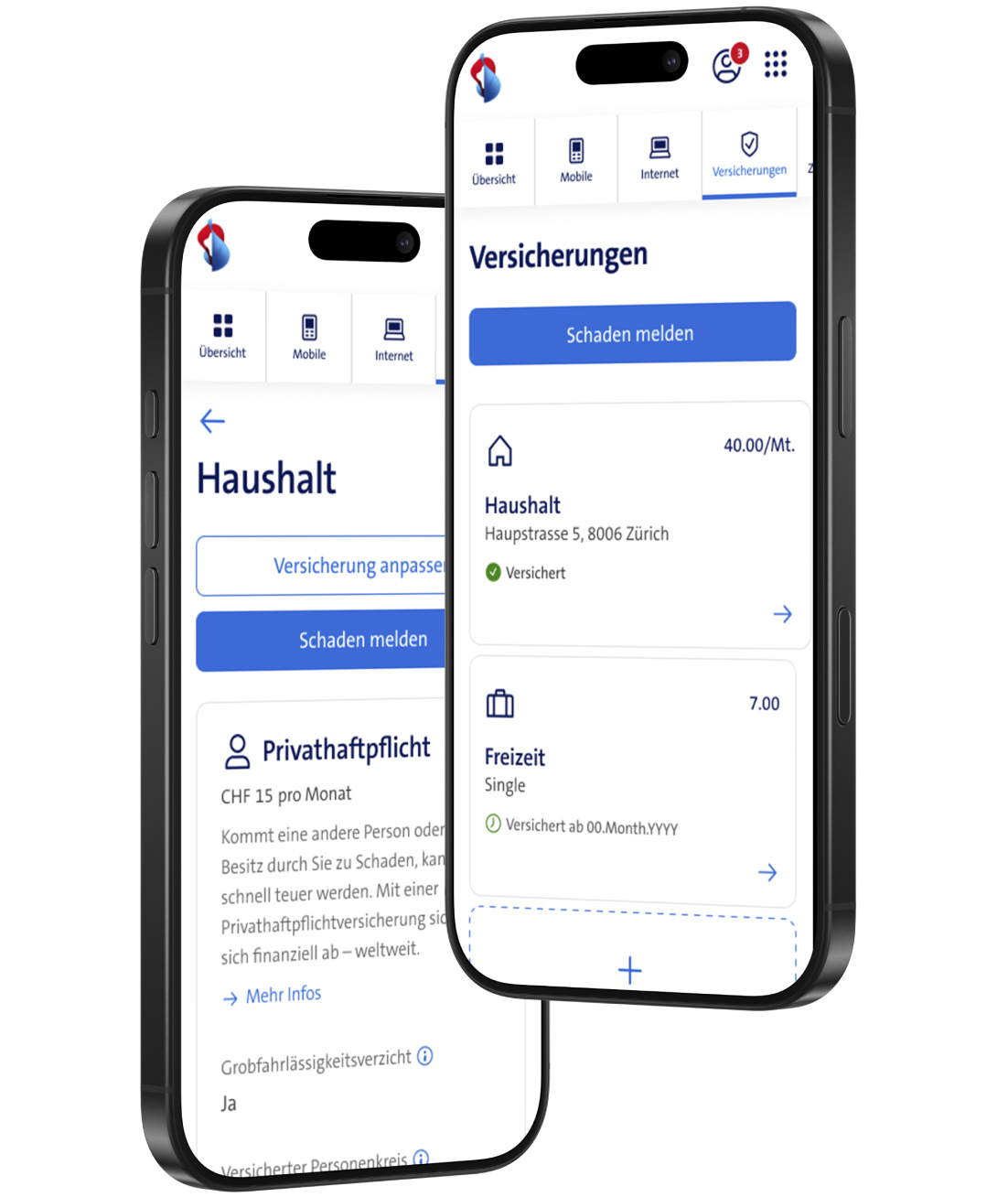

Everything in the My Swisscom app

You will find everything relating to your insurance subscription in the My Swisscom app.

| | Policy, documents, bills |

| | Report claims |

| | Change cover and options |

| |

Cancellation template: We’ll help you switch to us.

Frequently asked questions

When is it worth getting travel insurance?

Where is the travel insurance valid?

When is the travel insurance valid from?

Can travel insurance be canceled monthly?

Does travel insurance also equate to health insurance abroad?

Is my luggage also covered?

How high is the travel insurance excess?

How do you claim on Swisscom leisure insurance?

We would be happy to advise you personally

If you have any questions, please contact the Swisscom sure Customer Care team.

Free: Lines are open Monday to Friday 8 am to 5 pm.

Make a claim

If you need to make a claim, you can contact ERV’s claims service directly.

Online: www.erv.ch/schaden(opens in new tab)

Telephone: +41 58 275 27 27

E-Mail: schaden@erv.ch