“In a challenging environment, we performed successfully last year and achieved a strong operating result with slightly lower revenue”, states CEO Urs Schaeppi with satisfaction. “The success is even more remarkable given that, as a result of COVID-19, over 80% of our employees worked from home and kept the operation running at all times, even when the network was under strain. In addition, the market environment continues to be characterised by aggressive promotions, intense competition and price erosion in the Swiss core business. I was particularly pleased by the fact that we emerged as the winner in all mobile network tests in Switzerland and by the high level of customer satisfaction among residential and business customers. We were able to compensate for the negative effects of COVID-19 on blue’s roaming and content offerings thanks to growth in security and cloud solutions and at Fastweb, as well as efficiency gains. Our subsidiary Fastweb in Italy is enjoying sustained growth in revenue, operating profit and customers. For 2021, we expect business in the Group to be robust despite uncertainties due to COVID-19.”

High price pressure in core business in Switzerland, growth at Fastweb

Group revenue decreased by 3.1% to CHF 11,100 million, while operating income before depreciation and amortisation (EBITDA) rose by 0.6% to CHF 4,382 million. On a like-for-like basis and at constant exchange rates, revenue declined by 2.3% while EBITDA remained stable. The COVID-19 pandemic has had a negative impact, particularly on roaming revenues, but the overall net effect on operating income remained low. In its saturated core business in Switzerland, Swisscom generated revenue of CHF 8,275 million (-3.5%). The CHF 298 million decline in revenue is mainly driven by ongoing price pressure and the impact of COVID-19; roaming accounts for around a third of this decline (CHF 89 million). Business in Italy performed positively: Fastweb reported year-on-year revenue growth of EUR 86 million (+3.9%).

In the Swiss core business, EBITDA increased by 1.2% to CHF 3,527 million; on an adjusted basis, EBITDA decreased by 0.5%. This decline was due to lower revenue although it was largely offset by higher efficiency. At Fastweb, EBITDA rose by 4.5% to EUR 784 million.

Operating income (EBIT) increased by 1.9% to CHF 1,947 million. The bottom line shows net income of CHF 1,528 million, which is CHF 141 million or 8.4% below the previous year’s result. It must be considered that a positive one-off effect of CHF 269 million was included in income tax expense in the previous year.

Technology leader thanks to high network investments

Swisscom continuously invests in the quality, coverage and performance of its network infrastructure, reinforcing its position at the cutting edge of technology. At CHF 2,229 million (-8.6%), Group-wide capital expenditure remained high and comparatively stable. In 2019, CHF 196 million was attributable to expenditure on 5G mobile radio frequencies.

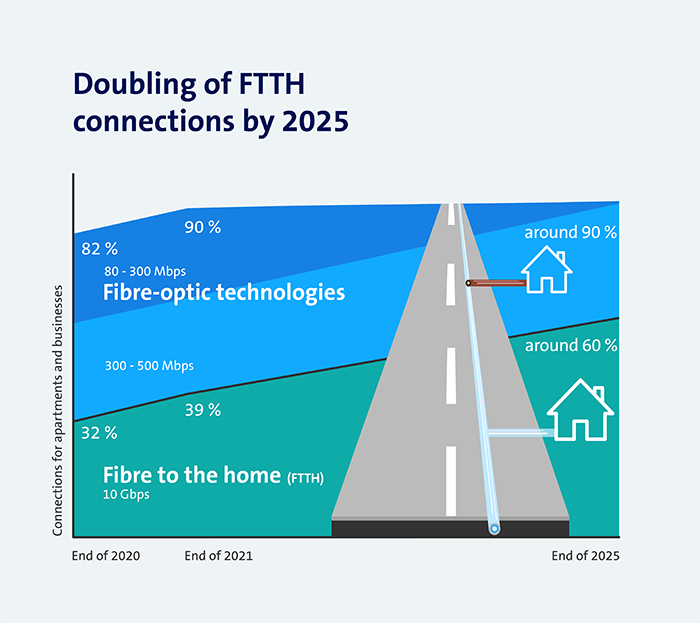

Broadband expansion in the fixed network on course

As at the end of 2020, Swisscom had connected around 4.4 million or 82% of homes and businesses in Switzerland to its ultra-fast broadband service (speeds in excess of 80 Mbps). Meanwhile, over 3.1 million or 59% of homes and businesses enjoy fast connections with speeds of more than 200 Mbps. The coverage for speeds of 10 Gbps is around 32%. Swisscom will make ultra-fast broadband available in every municipality by the end of 2021, even in remote locations.

With its aspiration to offer all customers the best network in Switzerland everywhere and at all times, Swisscom has set itself an ambitious expansion target. By the end of 2025, fibre-optic coverage to homes and businesses (FTTH) is set to increase to 60%.

Rapidly growing demand requires fast expansion of the mobile network

As at the end of 2020, Swisscom’s 4G/LTE network covered 99% of the Swiss population. What is needed is even more speed: on a test track, a transmission speed of 1 Gbps was achieved in a moving train by bundling 4G and 5G. Swisscom currently covers 96% of the Swiss population with a basic version of 5G. As at the end of 2020, Swisscom had 1,239 antennas in 522 locations with full 5G+.

As a result of the increased demand, data volumes on the mobile network increased by 29% year on year. Since 2010, the data volume has increased more than a hundredfold. The expansion of the mobile network is more important than ever in order to prevent data congestion in the network and to further advance the digitisation of the economy and society.

Convergence: Bundled offering inOne continues to grow

The number of TV and broadband connections remains high, and demand for bundled offerings continues. Residential customers in particular appreciate the modular, flexible inOne subscription.

inOne as a key driver of convergence

At the end of 2020, Swisscom had 2.45 million inOne customers in the residential customer segment. inOne accounts for 68% of all mobile subscriptions and 76% of broadband connections in this segment, while 46% of customers use a combined offer.

Growth in second and third brands

The markets for broadband and TV are saturated and heavily driven by promotional offerings. The number of fixed-network broadband connections declined slightly year-on-year, despite second and third brands growing by 14,000 connections. The number of TV connections remained stable. The downward trend in traditional fixed-line telephony is slowing due to the migration to IP which is now complete: as at the end of 2020, Swisscom had 1.52 million fixed-line telephony connections, which corresponds to an annualised decline of 71,000 connections.

The number of postpaid connections in mobile communications rose by 81,000 compared with the previous year. Of these, 62,000 were attributable to second and third brands such as Wingo and M-Budget Mobile. The number of prepaid lines fell by 190,000. At the end of 2020, Swisscom’s mobile lines numbered 6.22 million.

blue stands for TV, streaming, cinema and gaming – boom in smart home

In the area of entertainment services, Swisscom launched the Swisscom blue product family in September: a comprehensive entertainment experiences with new offers and new content that can be accessed from anywhere. The basis for this new offering is blue TV. Bluewin is now called blue News, and blue+ is becoming the leading Swiss streaming and pay TV provider. Customers of competitors can also use Blue. Since 20 October, Swisscom customers have also once again been able to tune in live to the games of the highest leagues in Swiss ice hockey and will never need to miss another match. The MySports channels can be easily subscribed to directly via the blue TV platform with just a few clicks and paid for via the Swisscom bill.

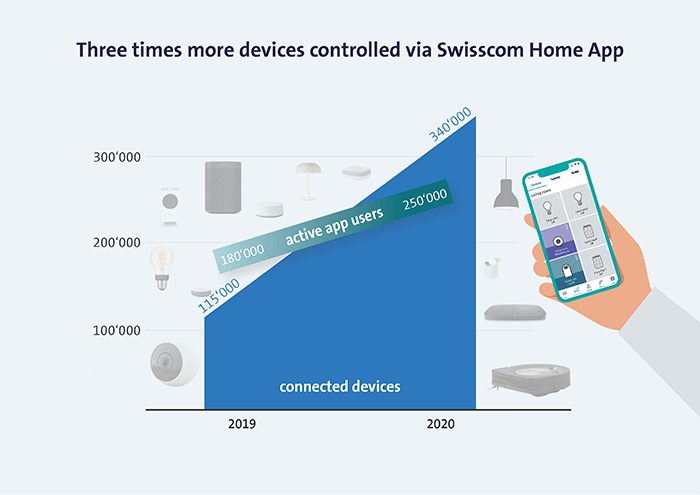

Home networking (smart home) for controlling lighting, music or alarm systems is also growing strongly. By the end of 2020, 340,000 devices were already connected via Swisscom’s Home app, almost three times as many as a year earlier. 250,000 customers used the app regularly (+39%). To simplify customer contact, the My Swisscom app provides direct access to current costs, bills and products. The app has already been downloaded over 1.2 million times and is actively used by just under half.

Business customers: Fierce competition and increasing demand for ICT solutions

The market for business customers is still dominated by tough competition and new technologies. Revenue from telecommunications services fell by 6.6% year on year to CHF 1,721 million. Swisscom has a strong position as a full service provider and customer satisfaction remains high. The areas covered by the cloud, security and unified communications and collaboration solutions (e.g. conferencing services) all posted growth. Revenue in the solutions business remained virtually stable at CHF 1,058 million (+0.9%).

Fastweb registers growth in customer base, revenue and operating income

Fastweb in Italy had another successful financial year, recording impressive growth. Its fixed-line broadband business exhibited positive growth: the number of broadband customers went up by 4.2% to 2.75 million within the space of a year. Its mobile communications business also grew, up 12.3% compared to the previous year, reaching 1.96 million customers in a saturated and highly competitive market. Fastweb is placing a stronger focus on convergence: 34% of subscribers already use a bundled offering combining fixed network and mobile services.

The business customer segment also continued to exhibit positive growth with revenue growth of EUR 45 million (+5.2%). Overall, Fastweb was able to increase its revenues to EUR 2,304 million (+3.9%). Earnings before interest, taxes, depreciation and amortisation (EBITDA) rose to EUR 784 million (+4.5%).

Changes on the Board of Directors

The one-year term of office of all members of the Board of Directors expires at the Annual General Meeting on 31 March 2021. As already announced, the Chairman of the Board of Directors, Hansueli Loosli (1955), will reach the maximum term of office of twelve years stipulated in the Articles of Association at the Annual General Meeting and will therefore not stand for re-election. Michael Rechsteiner (1963) who has been a member of the Board since 2019 is the proposal of the Board of Directors for Chairman. The other members of the Board of Directors are standing for re-election.

The Board of Directors is proposing Guus Dekkers (1965) for election as a new member of the Board. Guus Dekkers is a native Dutchman. He has a high level of technology expertise and broad experience of international management and transformation in both consumer and business markets across a range of industries. He is currently Chief Technology Officer at the retail chain Tesco Plc in London, where he is responsible for the digitisation of all Tesco’s worldwide activities. He holds Master’s degrees in Computer Science and Business Administration.

A proposal will be made to the Annual General Meeting to pay an unchanged dividend of CHF 22 per share for the 2020 financial year. Due to COVID-19 and the ordinance on combating the pandemic, the Board of Directors has decided to host the 2021 Annual General Meeting virtually as in 2020. Shareholders will be informed in due course.

Outlook for 2021: EBITDA of around CHF 4.3 billion

For the 2021 financial year, Swisscom expects net revenue of around CHF 11.1 billion, EBITDA of around CHF 4.3 billion and capital expenditure of around CHF 2.3 billion. Subject to achieving its targets, Swisscom will propose to pay an unchanged, attractive dividend of CHF 22 per share for the 2021 financial year at the 2022 Annual General Meeting.

Tough competition and high pressure on prices will continue in the company’s core business in Switzerland. As already announced, Swisscom aims to continue reducing its cost base by CHF 100 million in 2021 and again in 2022, as it has in previous years. The savings will be realised mainly by simplifying work processes, using more efficient systems, and reducing the number of jobs advertised. In contrast, new jobs will be created in growth areas such as the cloud and security. Overall, Swisscom expects vacancies in Switzerland to decline slightly in 2021, depending on market developments. By means of careful planning, Swisscom aims to continue to cushion the reduction through natural fluctuation and retirements as much as possible, or to find alternative solutions. As previously, Swisscom is also firmly committed to the training of apprentices and will be making around 900 apprenticeships available in 2021.

1.1.-31.12.2020 |

1.1.-31.12.2019 |

Change (adjusted*) | |

|---|---|---|---|

Net revenue (in CHF million) |

11,100 |

11,453 |

-3.1% |

Operating income before |

4,382 |

4,358 |

0.6% |

Operating income, |

1,947 |

1,910 |

1.9% |

Net income (in CHF million) |

1,528 |

1,669 |

-8.4% |

TV connections in Switzerland |

1,554 |

1,555 |

-0.1% |

Retail broadband connections in Switzerland |

2,043 |

2,058 |

-0.7% |

Mobile access lines in Switzerland |

6,224 |

6,333 |

-1.7% |

Fastweb broadband connections |

2,747 |

2,637 |

4.2% |

Fastweb mobile lines |

1,961 |

1,746 |

12.3% |

Capital expenditure (in CHF million) |

2,229 |

2,438 |

-8.6% |

Of which capital expenditure in Switzerland (in CHF million) |

1,596 |

1,770 |

-9.8% |

Group employees (FTEs as at 31 December) |

19,062 |

19,317 |

-1.3% |

Of which employees in Switzerland (FTEs as at 31 December) |

16,048 |

16,628 |

-3.5% |

* On a like-for-like basis and at constant exchange rates

Swisscom uses various alternative performance indices. The definition and reconciliation of values in accordance with IFRS are set out in the chapter on business performance in the 2020 annual report.

Downloads

-

Press Release

(PDF file, 182 KB)

-

Presentation

(PDF file, 6 MB)

-

Picture Urs Schaeppi

(JPG file, 247 KB)

-

Picture Guss Dekkers

(JPG file, 83 KB)

-

Picture Fixed network expansion

(PNG file, 169 KB)

-

Picture Smart Home

(PNG file, 182 KB)

Disclaimer

This press release contains forward-looking statements. In this press release, such forward-looking statements may include, but are not limited to, statements relating to our financial position, operating results and certain strategic plans and objectives.

Because these forward-looking statements are subject to risks and uncertainties, actual future results may differ materially from those expressed in or implied by the statements. Many of these risks and uncertainties relate to factors which are beyond Swisscom’s ability to control or estimate precisely, such as future market conditions, currency fluctuations, the behaviour of other market participants, the actions of governmental regulators and other risk factors detailed in Swisscom’s and Fastweb’s past and future filings and reports, including those filed with the U.S. Securities and Exchange Commission and in past and future filings, press releases, reports and other information posted on Swisscom Group Companies’ websites.

Readers are cautioned not to put undue reliance on forward-looking statements, which speak only of the date of this communication.

Swisscom disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Subscribe to news

Subscribe to our news by e-mail

Contact us

Address

Swisscom

Media Relations

Alte Tiefenaustrasse 6

3048 Worblaufen

Postal address:

Postfach, CH-3050 Bern

Switzerland

Contact

Tel. +41 58 221 98 04

media@swisscom.com