“Swisscom is reporting solid results and a good market performance – despite market saturation, tough competition and persistent price pressure in all segments,” said CEO Urs Schaeppi. “Our products have performed very well: the number of broadband and TV connections grew in the last quarter. Our latest inOne mobile offering also continues to enjoy high demand and is today used by around 890,000 customers. Interestingly, the holiday season highlighted that our customers with unlimited roaming actually use more mobile data when travelling in Europe than when in Switzerland. Switzerland needs powerful, state-of-the-art infrastructure to cope with the enormous data volumes and demand for stationary and mobile applications on the part of our residential and business customers. That is why Swisscom is expanding the 5G mobile network further and making modern fibre-optic technologies available to an average of one new municipality per day. By the end of 2021, Swisscom will provide ultra-fast broadband to all Swiss municipalities and to 90% of homes and offices in Switzerland. Our Fastweb subsidiary also performed well again, increasing its residential and business customer bases.”

CEO Urs Schaeppi on the Q3 2019 results

Healthy Group results, Swiss core business under pressure, growth at Fastweb

At CHF 8,456 million, Group revenue was down year-on-year (–2.7%). At constant exchange rates, this represents a decrease of 1.9%. In its largely saturated Swiss core business, Swisscom generated revenue of CHF 6,367 million (–3.3%). The CHF 217 million drop in revenue from telecommunications services was mainly the result of falling prices in various segments and the decrease in fixed-line telephony connections. Business in Italy continued to perform positively: Fastweb reported year-on-year revenue growth of EUR 68 million (+4.5%).

Consolidated operating income before depreciation and amortisation (EBITDA) came to CHF 3,360 million, which was 4.0% above the previous year. The year-on-year development was impacted by new requirements governing the financial reporting of leases (IFRS 16). On a like-for-like basis, EBITDA is at exactly the same level as the previous year. EBITDA in Swiss core business fell by 1.5%. This decrease, resulting from lower revenue, was largely offset by ongoing cost-cutting measures. Fastweb’s EBITDA in local currency increased by 6.7%. Swisscom’s net income was CHF 1,181 million (–2.6%).

Network infrastructure: continued high investment, 5G for the whole of Switzerland

Swisscom continuously invests in the quality, coverage and performance of its network infrastructure, further consolidating its technology leadership. As at the end of September, capital expenditure totalled CHF 1,833 million (+13.1%). This included CHF 196 million on mobile frequencies for the 5G network in Switzerland purchased at auction in the first quarter. That equates to a 2.2% increase in like-for-like investment spending.

Broadband expansion on track

Investment in broadband networks is being stepped up. Swisscom connects more than 70% of all Swiss homes and offices with ultra-fast broadband speeds of more than 80 Mbps. Over 43% of all homes and offices enjoy connections with speeds of more than 200 Mbps.

Final phase of the switch to IP

The switch to IP technology is proceeding according to plan and has been largely completed in the residential and SME market. All remaining customers have been informed of the switchover date. The switch to IP is scheduled for completion by the end of 2019.

Broadband on the mobile network

The expansion of the mobile network also continues: as at the end of September 2019, Swisscom covered 99% of the Swiss population with its 4G/LTE network. Over 96% of the Swiss population surf at speeds of up to 300 Mbps, over 72% at speeds of up to 500 Mbps and around 27% at 700 Mbps. Swisscom also put its 5G network into operation on 17 April 2019 and is one of the first providers worldwide to offer fully standardised 5G networks. Swisscom is expanding the 5G network in phases and plans to roll out 5G to 90% of the population by the end of the year.

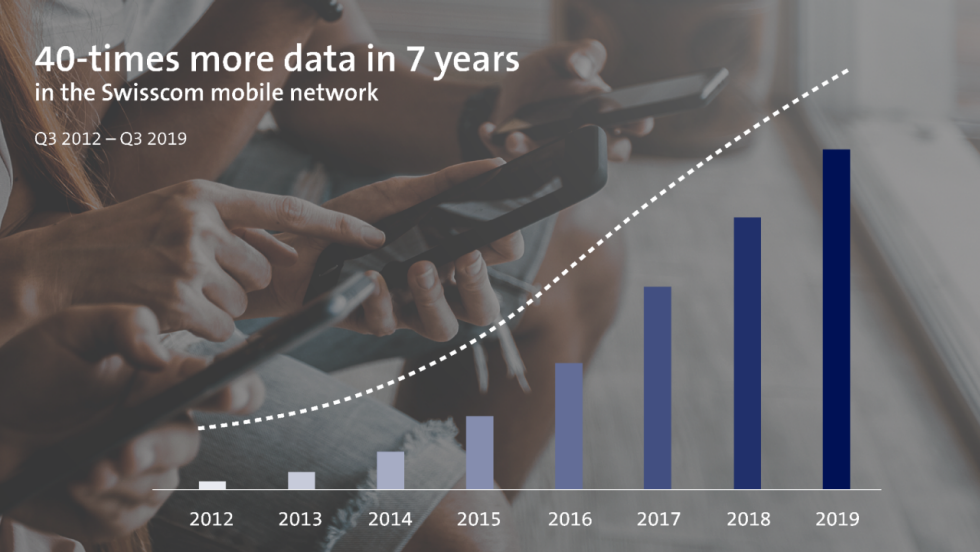

Investing in a future-proof mobile network is becoming all the more crucial given that mobile data usage has been on the rise for years. Since the introduction of a flat rate seven years ago, the use of mobile data services in Swisscom’s mobile network alone has increased fortyfold. The rise is set to continue.

Top product inOne continues to gain ground

The number of TV and broadband connections remains high, and demand for bundled offerings is intact. Residential customers particularly appreciate the modular and flexible inOne subscription.

More customers using inOne

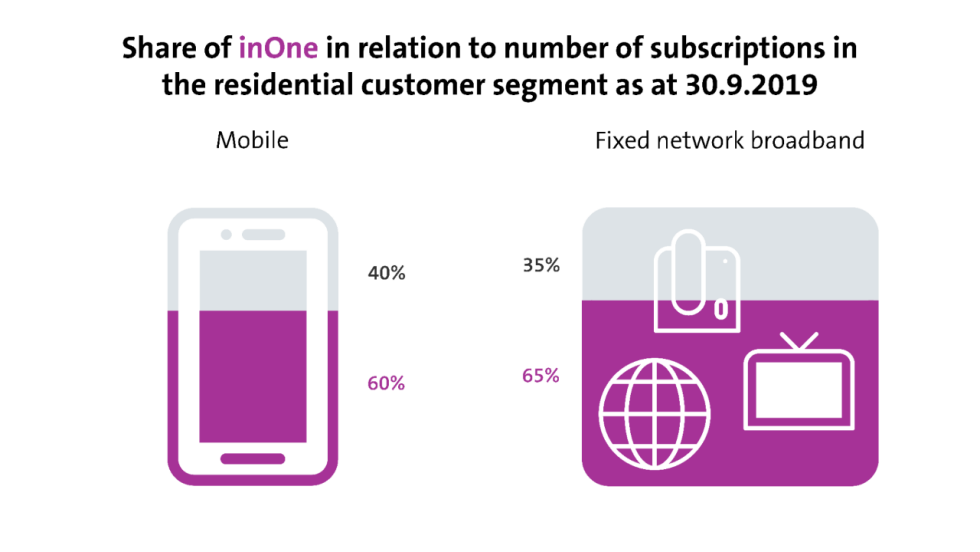

At the end of September, Swisscom had 2.67 million registered inOne customers. The inOne mobile offering launched in April has already attracted around 890,000 customers. inOne accounts for 60% of all mobile phone subscriptions in the residential customer segment and for 65% of fixed-line broadband connections.

Slight growth at Swisscom TV

The broadband and TV markets are saturated and heavily promotion-driven. Although the number of fixed-line broadband connections is down 3,000 or 0.1% year-on-year at 2.03 million, an increase of 3,000 connections was reported in the third quarter of 2019. Over the same period, the number of TV connections rose by 11,000, which translates into a year-on-year rise of 30,000 or 2.0% to 1.54 million.

The downward trend in traditional fixed-line telephony is slowing among residential customers: At the end of September, Swisscom had 1.54 million fixed-line phone connections in this segment, which corresponds to a decline of 27,000 connections in the third quarter of 2019.

Growth in roaming data volumes continues

In a saturated mobile market environment, the number of postpaid lines grew by 31,000 in the third quarter or by 85,000 year-on-year, while the number of prepaid lines fell by 136,000 over the same period. In all, Swisscom reported 6.36 million mobile lines as at the end of September.

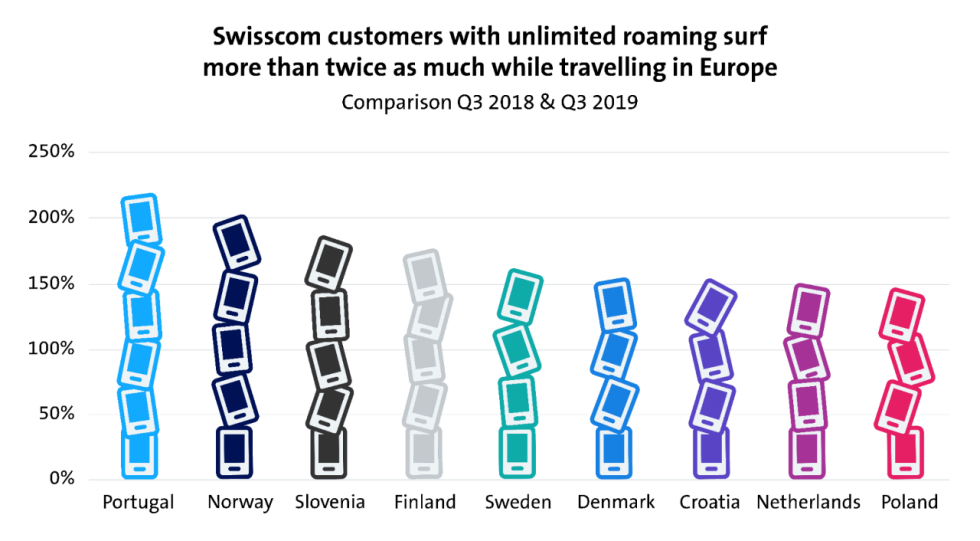

Roaming data volumes outside Switzerland more than doubled year-on-year, thanks to price reductions and additional inclusive services in inOne mobile subscriptions. Growth in the holiday months of July, August and September was even higher in some countries. inOne gives Swisscom customers unlimited calls, text messages and data in 39 European countries.

Competition remains tough in corporate business

The corporate customer market remains fiercely contested, as the trend of the first half-year has continued. Price pressure remains high, and the switch to IP has largely been completed. Revenue from telecommunications services fell by 10.9% or CHF 85 million year-on-year to CHF 698 million. Demand for cloud, security and IoT solutions continued to rise. Workplace system operation volumes decreased. However, revenue in the merchandise business made up for the downturn in the solutions business.

Fastweb registers growth

Fastweb again performed healthily in the third quarter. There was a positive showing for its fixed-line broadband business, with the number of broadband customers rising to 2.61 million (+3.7% year-on-year). Its mobile communications business also grew, reaching more than 1.74 million customers (+32% year-on-year) in a saturated and highly competitive market. Fastweb is increasingly focusing on convergence: 34% of its customers already use packages that bundle together fixed-line and mobile telephony.

The corporate business segment also continued to perform positively, with revenue growth of EUR 69 million (+12.4%). Fastweb was able to increase its revenue in the first nine months to EUR 1,584 million (+4.5%). Operating income before depreciation and amortisation (EBITDA) rose to EUR 529 million (+6.7%).

Marc Werner to leave Swisscom – new Retail Customers division

Marc Werner, Head of Sales & Services and Member of the Group Executive Board, is leaving Swisscom to take on a new challenge as CEO of another company. The Swisscom Board of Directors and Group Executive Board are very sorry to see Mr Werner leave and would like to thank him for his outstanding commitment to the company and wish him all the best for the future.

The Sales & Services (SAS) and Products & Marketing (PMK) divisions will be merged with effect from 1 January 2020. The new Retail Customers division will be headed by Dirk Wierzbitzki, the current Head of PMK.

Financial effects of tax reform

The tax reform approved in the May 2019 referendum will lead to a reduction of approximately 1.5 percentage points in Swisscom’s average Group tax rate to 19.5% from 2020. Extraordinary positive tax effects will be reported in the consolidated financial statements for full-year 2019. These stem from the accounting treatment of deferred taxes in accordance with international financial reporting standards (IFRS) due to lower cantonal tax rates and valuation adjustments following the transitional regime for the standard taxation of holding company profits.

Around CHF 60 million had already been recognised in the income statement by September 2019. A remaining amount of CHF 200 million is expected to be booked in the fourth quarter of 2019. These tax effects in the 2019 consolidated financial statements will not affect current tax payments, but will instead be spread over a period of some ten years.

Financial outlook remains unchanged

Swisscom continues to expect net revenue of around CHF 11.4 billion and EBITDA of more than CHF 4.3 billion for the 2019 financial year. The projected capital expenditure of around CHF 2.5 billion also includes the CHF 196 million spent on mobile frequencies in Switzerland. Subject to achieving its targets, Swisscom will propose payment of an unchanged, attractive dividend of CHF 22 per share for the 2019 financial year at the 2020 Annual General Meeting.

| 1.1.-30.09.2018 | 1.1.-30.09.2019 | Change (adjusted*) |

|

|---|---|---|---|

| Net revenue (in CHF million) | 8,689 | 8,456 | –2,7% (–1.9%) |

| Operating income before depreciation and amortisation, EBITDA (in CHF million) | 3,231 | 3,360 | 4.0% (0.0%) |

| Operating income, EBIT (in CHF million) | 1,621 | 1,529 | –5.7% |

| Net income (in CHF million) | 1,213 | 1,181 | –2.6% |

| Swisscom TV connections in Switzerland (as at 30 September in thousands) | 1,510 | 1,540 | 2.0% |

| Retail broadband access lines in Switzerland (as at 30 September in thousands) | 2,030 | 2,027 | –0.1% |

| Mobile access lines in Switzerland (as at 30 September in thousands) |

6,409 | 6,358 | –0.8% |

| Fastweb broadband access lines (as at 30 September in thousands) |

2,518 | 2,610 | 3.7% |

| Fastweb mobile access lines (as at 30 September in thousands) |

1,324 | 1,742 | 31.6% |

| Capital expenditure (in CHF million) | 1,621 | 1,833 | 13.1% |

| Of which capital expenditure in Switzerland (in CHF million) | 1,119 | 1,338 | 19.6% |

| Group employees (FTEs as at 30 September) | 19,850 | 19,500 | –1.8% |

| Of which employees in Switzerland (FTEs as at 30 September) | 17,165 | 16,788 | –2.2% |

* On a like-for-like basis and at constant exchange rates

Downloads

-

Press Release

(PDF file, 188 KB)

-

Visual material

(ZIP file, 25 MB)

Disclaimer

This press release contains forward-looking statements. In this press release, such forward-looking statements may include, but are not limited to, statements relating to our financial position, operating results and certain strategic plans and objectives.

Because these forward-looking statements are subject to risks and uncertainties, actual future results may differ materially from those expressed in or implied by the statements. Many of these risks and uncertainties relate to factors which are beyond Swisscom’s ability to control or estimate precisely, such as future market conditions, currency fluctuations, the behaviour of other market participants, the actions of government regulators and other risk factors detailed in Swisscom’s and Fastweb’s past and future filings and reports, including those filed with the US Securities and Exchange Commission, and in past and future filings, press releases, reports and other information posted on Swisscom Group companies’ websites.

Readers are cautioned not to put undue reliance on forward-looking statements, which are only valid at the time of this communication.

Swisscom disclaims any intention or obligation to update or revise any forward-looking statements, whether on the basis of new information, future events or otherwise.

Subscribe to news

Subscribe to our news by e-mail

Contact us

Address

Swisscom

Media Relations

Alte Tiefenaustrasse 6

3048 Worblaufen

Postal address:

Postfach, CH-3050 Bern

Switzerland

Contact

Tel. +41 58 221 98 04

media@swisscom.com