Is moving all our data back to private hard disks and deleting our accounts really the only way to protect ourselves effectively? Yes, but it's not a very practical and completely unrealistic resolution. For this reason, well-known portals and cloud operators such as Facebook, Apple or Whatsapp, but also Swisscom, rely on so-called 2-factor authentication (2FA), which uses an additional layer of security.

As the name suggests, 2-factor authentication requires two of a total of three possible factors for a successful login.

The three possible permitted factors are:

- Possession - something I own as a user, such as a credit card or mobile phone

- Knowledge - something that only I know as a user, such as my username, password, PIN or one-time password

- being - something that is inseparable from me as a physical characteristic, such as my fingerprint, my iris or the sound of my voice

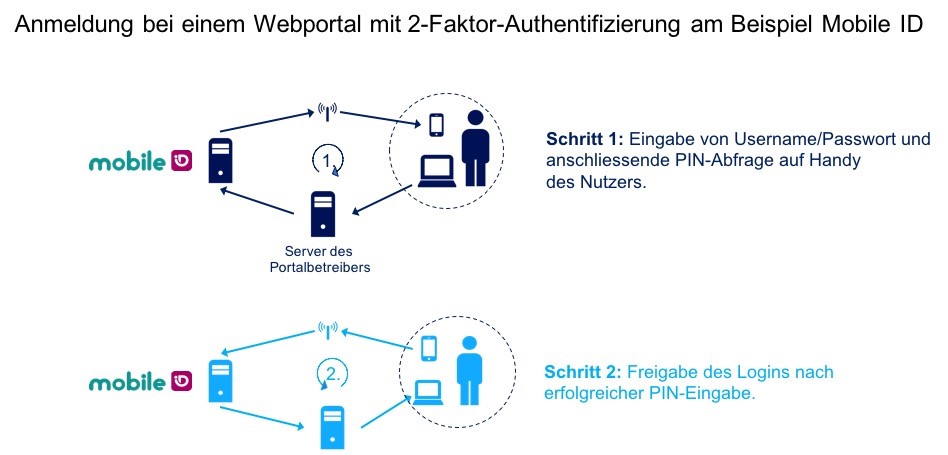

This means that not only the password (knowledge) is required for a successful login, but you also have to be in possession of a mobile phone, for example, on which you have to confirm a login attempt or possibly even transmit a one-time PIN sent by SMS to the Web browser. So someone would not only have to know my password, but also steal my mobile phone at the same time. This simple measure increases the protection of our data immensely without losing much convenience.