10x Banking – Modern core banking system set to shape the future of banking for the benefit of customers

Neo-core banking providers want to increase the agility and flexibility of IT architectures and enable banks to better tailor their services to the needs of end customers. 10x Banking also wants to make the future of banking more customer-oriented.

In cooperation with the Business Engineering Institute St. Gallen (BEI), Swisscom’s Core Banking Radar has been monitoring banks’ system support services since 2017 and analysing the most relevant systems for the Swiss market using a comprehensive assessment model(opens in new tab). This article looks at the special features of the 10x Banking platform, in detail, along with its capabilities and differentiating features.

December 2024, Tanyel Tunçer (BEI St. Gallen), Clemens Eckert (Swisscom) 11 min.

In a nutshell – Key features of 10x

Customer-centred innovation: 10x Banking was founded in 2016 with the aim of using technology to create a customer-centred banking experience. The platform aims at helping banks leverage customer data, get new products to market faster and create connected customer experiences.

Platform functionality: 10x Banking offers functionalities for payment transactions, accounts, loans and financing products for both private and corporate customers. The platform supports all payment methods and global standards, enables the creation of virtual accounts and provides development tools and infrastructure for rapid innovation.

Technical characteristics: The platform offers a secure banking infrastructure based on a cloud-native microservices architecture. An API gateway enables access via REST and GraphQL APIs. From an accounting perspective, it has the capability of a subledger, with the ability for bookings to be generated and retrieved in real time. The bank records and processes these events in a booking core outside of 10x or in a secondary system.

Business model and market positioning: 10x Banking offers volume-based pricing models for SaaS managed services, along with annual licence and maintenance fees for on-premise solutions. The company aims to modernise core banking systems for large and medium-sized banks and is already used by financial institutions, e.g. in England, South Africa and Australia.

Higher demands on agility and flexibility

Customer orientation is a key issue for banks, as customers are no longer looking for banking products, but instead focusing on their individual needs. This also illustrates the urgency for business processes to be designed holistically from a customer perspective that goes beyond industry-specific boundaries. In a highly competitive environment, banks are increasingly reliant on providing a seamless digital customer experience as quickly and cost-effective as possible.

To meet these requirements, today’s IT architectures rely on standardised and reusable APIs. By transitioning from traditional integration methods to an API-centric strategy, backend systems become more flexible and integrate seamlessly into the application landscape, reducing time and effort, and improving the delivery of internal and external services. APIs also promote flexibility in the IT architecture and enable a clear separation between data, applications and systems. This decoupling leads to an additional layer of integration, allowing banks to design their services to be more independent of infrastructure and application changes.

Microservices and modularity can further increase agility by dividing the architecture into standalone units that can be independently developed, tested and deployed. Where a clear professional division is provided, they enable independent technical decisions and the formation of autonomous agile teams that can work independently.

While some banks have adopted neo-core systems for greater agility, these come often with their own set of limitations, including scaling issues and limited customization options. As a SaaS banking platform, 10x makes targeted use of these concepts. Its API integration capabilities, its modular design with hooks and cloud-native architecture promises banks to achieve high levels of rapid service innovation, adaptability and scalability when it comes to their IT systems. These are all key elements for success in today’s dynamic market environment.

Background and overview of 10x

In 2016, 10x Banking was born out of the conviction to use technology to create a customer-centred banking experience. Aiming to put the end customer at the centre of all services, Antony Jenkins, former Group CEO of Barclays, founded 10x Banking and set the stage for the development of a new core banking system. Based on industry expertise and the approach to supporting end-to-end customer journeys, a comprehensive and robust technology platform was created.

The 10x banking platform is built as a meta core, a next-generation core banking system designed to eliminate the limitations of both traditional and neo-cores. It aims to empower banks to rapidly develop and deploy highly customized banking products without the complexity inherent in monolithic architectures.

The 10x banking platform was designed from scratch as a stateless microservice platform. The microservices are written in Java, orchestrated with Kubernetes and use PostgreSQL and Apache Kafka-compatible databases and event-driven systems. Access takes place via an API gateway that uses REST and GraphQL APIs. From an accounting perspective, the platform has the capability of a subledger, with the ability of debit and credit bookings to be generated and retrieved in real time. The bank can then process these events in the existing core legacy banking system or in another external booking core.

An initial overview of the features and capabilities of the 10x platform:

- Cloud-native architecture: Fully operated in the cloud, the meta core banking system ensures high resilience, scalability and easy integration.

- API-First Approach: Seamless integration with both existing and new systems thanks to highly customizable APIs to extend or modify core functionality.

- Modular Design: Pre-built modules for banking functions to create complex financial products, with hooks serving as predefined integration points to facilitate personalization.

- Dynamic infrastructure scaling: Continuous adaptation of resources to current. requirements through automated capacity management for efficient and cost-optimised use of computing capacities and storage resources.

Therefore, 10x Banking’s solution is aimed at financial institutions that want to transform their IT systems in relation to the customer experience in a digitised market environment and are looking to launch new banking products onto the market quickly. By using the banking system offered by 10x, these players aim to improve their digital offerings and implement new business models through the services provided (see section “Platform functionality” for further details). With this foundation, the company 10x positions itself as a global provider for established banks of different sizes and as a banking-as-a-service provider for fintechs & (challenger) banks.

10x Banking platform functionality

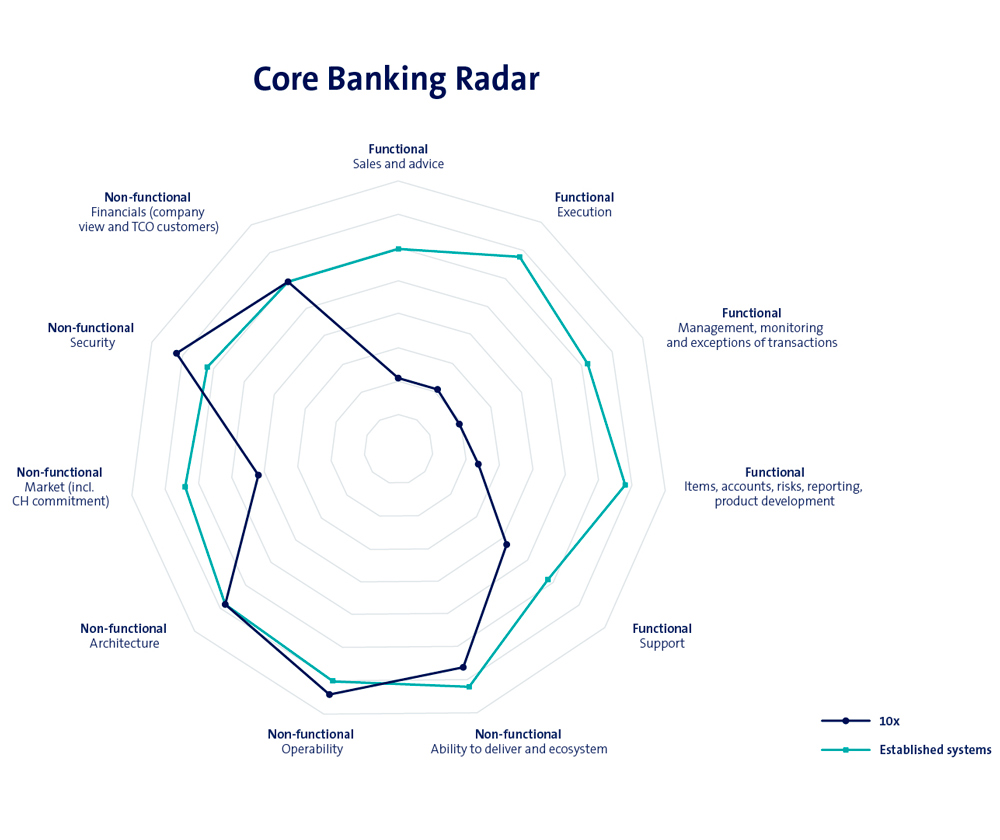

The functional scope of 10x essentially includes the areas of figures and finance . This is with a focus on payments, accounts, deposits and loans for both private and corporate customers. Figure 1 illustrates the areas of functional support for banking processes and services and the degree of non-functional support for system properties.

In terms of figures, 10x supports common processes (maps, SEPA, SWIFT) and global standards (ISO20022). The platform is designed for batch and real-time transactions alike and allows for the integration of transaction monitoring for comprehensive risk management. The system also offers the integration of local payment gateways, along with APIs for financing accounts and recording credit and debit transactions. With regards to the processing of card payments, it builds on this to provide integration via REST APIs and ensure compliant interoperability with other physical card infrastructures.

This functionality is complemented by high transaction processing capabilities. The 10x Banking platform does not have a fully-fledged general ledger, as only client-side transactions (e.g. payouts, incoming and outgoing payments, interest, fees, etc.) are recorded. Benchmarks include highly scalable transaction processing as well as the efficient management of mass customer onboarding operations, as happens, for example, in the marketing campaigns of neo-bank apps. The composition of the general ledger used can be selected freely. Banks can use, for example, SAP, Abacus or even self-built systems for this purpose. This is possible whenever the general ledger is not mapped in the core banking system.

Functional & non-functional coverage of 10x compared to established systems

One special feature is the creation of virtual accounts. In conjunction with the bank’s existing general ledger, the end customer’s centrally managed current account can be split into several virtual accounts, each with its own virtual IBAN. Although these virtual accounts have the same functionality as physical accounts, they function as individual subledgers on the system side in 10x. This process enables multiple virtual savings accounts to be created for bank customers, spending limits to be defined and savings plans to be opened flexibly. Bank-specific products can be connected via an API and integrated into the e-banking system. Similarly, for example, the integration of cashback offers, or the observance of a minimum credit limit offer possible dynamic rewards depending on customer behaviour.

10x supports mainstream financing services with a range of both secured and unsecured financing products. These range from flexible “Buy Now, Pay Later” options to specialised loans for SMEs and other types of loans. In online lending, end customers benefit from the flexibility to dynamically adapt repayment terms and repayment plans with their online lending to meet their own individual needs .

Another differentiating feature is product development, which provides banks with a toolkit (“10x ProductKit”) to rapidly build, customize, and manage banking products. It provides the tools, APIs, and pre-built modules necessary to create financial products efficiently, without the need for excessive code. By using 10x hooks that serve as predefined points or interfaces within the system, users are allowed custom code or additional logic to be inserted. This enables modifications or extensions to existing processes without the need to alter the core.

In combination with the foundational infrastructural layer of the 10x Banking platform (“10x Fabric”) a seamless communication between all system components—whether modules built with ProductKit or integrated third-party services—can be achieved. It ensures efficient scalability while upholding high standards of resilience and security. It enables real-time data flow, manages large transaction volumes, and ensures smooth integration across the platform.

The language-agnostic approach allows 10x customers to develop custom components in different programming languages and execute them in their preferred runtime environment regardless of the core. The seamless integration of channels and applications enables banks to offer tailor-made and efficient services to their end customers. Consequently, however, it is important not to underestimate integration complexity, but rather manage it.

In 10x, securities and their position keeping are currently not covered and have to be provided by peripheral systems. In general, extensions of 10x are developed based on customer demand, but also occasionally according to specific customer requirements. The 10x partner ecosystem is characterised by a selected network that complements and extends the capabilities. Together with more than 80 partners , 10x is able to offer a wide range of technical implementations as well as the mapping of additional services from the network.

Technical specifications

Architecture

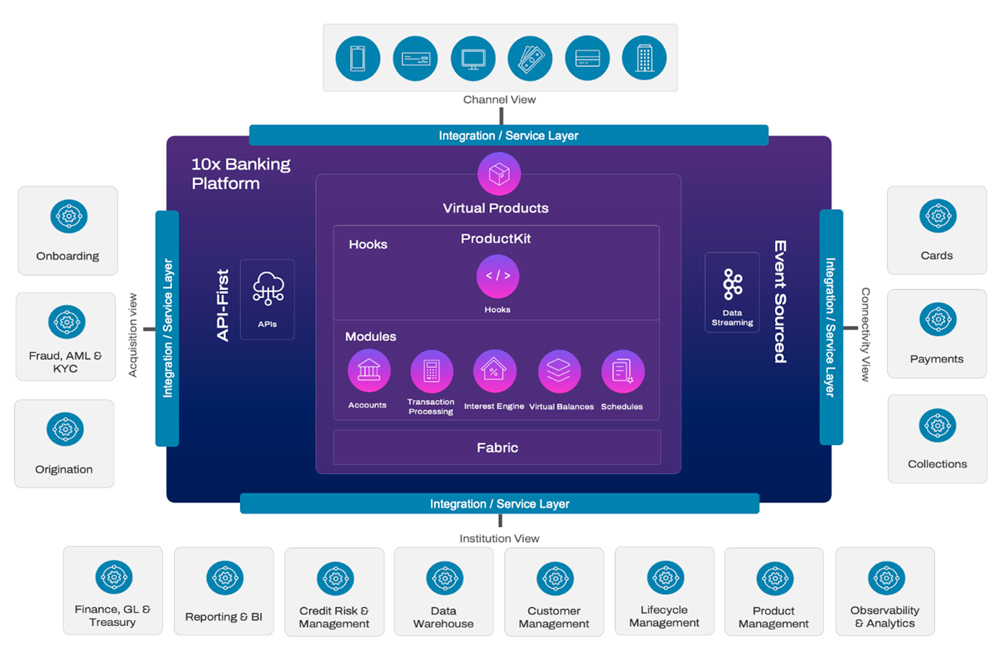

The platform offers a modular and expandable architecture (see Figure 2) that allows banks and their partners to customise and further develop the core product. This follows a modular approach with microservices that represent a smaller, functionally encapsulated context and offering an independent lifecycle. From a technical perspective, the platform uses the 10x “Fabric” to ensure integration. Access to product, general ledger, customer and payment services is achieved through a series of channel-independent REST APIs in the integration/ service layer that provide consistent access to banking function and its underlying services and processes.

The technologies used vary depending on the deployment model chosen, and Aurora is used as the database technology for the SaaS offering of 10x in the AWS environment. The platform possesses event-based logic to enable the real-time processing and analysis of business events. This structure can also be used for advanced analysis and queries. The platform’s multi-tenant capability allows for logically separate data storage and enhances data security between different instances. One special feature of 10x is that it allows banks to store their customer data either internally in the platform or externally in a CRM solution. In both scenarios, all customer accounts (loans and deposits) are linked to a basic customer record in the platform. This functionality allows the system to exchange data in real time in a customer-oriented manner, making a precise and individual customer approach possible.

Generic components of the 10x Banking platform (Source: 10x)

Operability

The services from 10x are available as a licensed solution, or as a SaaS managed service. The “self-hosted engagement model” also enables operation in an in-house cloud environment or in the customer’s own data centre. For this purpose, 10x provides the customer with binary files, containers and deployment scripts that permit individualisation, for example, in terms of availability (e.g. as an active-active cluster or as an active-passive cluster). As a cloud-native platform, the 10x platform is accessible globally via AWS, among others, simplifying the deployment, integration, and operation of banking infrastructure and reducing service costs. The aim is to ensure the scaling of the banking business with relatively favourable production with low TCO.

Security

The security architecture of the 10x Banking platform is based on the latest technologies and processes to ensure a robust and secure environment for digital banking. The platform is certified according to ISO-ISO27001 and SOC2 standards, which is confirmed by regular external audits. A secure development cycle with risk models ensures that the platform is resilient to cyber threats and provides a reliable build and runtime environment. Continuous monitoring of cloud environments and a dedicated security team also ensure a quick response to potential threats.

Business model and market positioning of 10x

10x Banking’s business model offers volume-based pricing as a SaaS managed service or an annual licence and maintenance fee as part of a customer-managed on-premise solution. In SaaS, 10x manages the entire infrastructure and deploys it on the environments of 10x’s cloud providers on the customer’s behalf. The SaaS fee covers the entire hosting service, including contracts with key technology and infrastructure partners, regulatory compliance, security, and related maintenance. All costs for the platform are included in the SaaS pricing and are based on actual usage. The on-premise solution is based on an annual licence and maintenance fee and is aimed at customers who want to be responsible for managing their core system themselves.

As a first step, 10x wants to target mainly larger and medium-sized banks that are seeking to modernise their core banking system. This is also underlined by its existing customer portfolio and partnerships with major banks, such as Chase Bank (UK), Westpac (AUS) or Old Mutual (SA). The company collaborated with Westpac to launch a transaction banking platform for institutional customers. This move, as part of Westpac’s digital transformation, aims to improve access to real-time data for more efficient cash management. Chase UK is primarily using the 10x platform to develop a new B2C product to make its retail banking offering scalable in the UK and bring it to market quickly. These are just examples of how 10x covers a dedicated part of the overall functionality of each bank.

With a team of more than 200 employees, 10x Banking operates worldwide with offices in London and Sydney. Geographically, its resources are initially concentrated on the two home markets of the UK and Australia, as well as on customers in South East Asia and Africa. Looking to the future, 10x is aiming for organic growth beyond its current markets, with plans to establish a presence in the D-A-CH region (Germany, Austria, and Switzerland), where discussions are already underway.

Architecturally, it continues to focus on product modularisation and work on seamlessly delivering the services currently offered either as an on-premise solution or as a fully managed SaaS solution. In combination with other Banking-as-a-Service (BaaS) offerings, banks will be given the ability to integrate financial services into services provided by other companies. This includes, for example, the possibility of opening accounts, transferring money or granting loans integrated with other services.

Conclusion

With its platform, 10x Banking offers an interesting software that promises a combination of flexibility, agility and a high level of integration into the digital banking ecosystem. The platform implements modern architectural paradigms such as microservices, API-first architecture and uses cloud technologies to provide banks with a robust, scalable and cost-effective infrastructure.

It also offers a relatively broad functional coverage through a transaction-focused approach. Banks can choose from different modules in the sense of a bank-in-a-box solution. These include the areas of card processing and administration or CRM functionalities, such as provisioning via different channels or automation solutions. This is complemented by the conviction that core banking systems and architectures will rely on microservices in the future and that organisations will also want to maintain flexibility in how they design things in the future. 10x is living an API-first approach on its platform to meet the needs of banks for a best-of-breed approach. Adifferentiating feature is the “10x ProductKit” for product development , which makes it possible to create banking products quickly while receiving real-time feedback on customer behaviour.

10x Banking is positioning itself to bridge the gap between established banks of different sizes as well as fintechs and challenger banks. The challenge lies in setting itself up as an integrative component for banks in an increasingly dynamic and interconnected market.