SolitX: Smart Financial Contracts as a new approach to system support for banks

With its SolitX platform, Swiss software manufacturer Ariadne Business Analytics is bringing a new approach to system support for banks to the core banking systems market.

Text: Werner Gygax / Thomas Zerndt, Images: Zense, 11 november 2019 12 min.

The basic concept relies on the digitisation of financial contracts – known as “Smart Financial Contracts”. The concept represents bank services in algorithmic form with clear instructions. This means that properties and changes over time can be mapped in a standardised way. The basic concept can essentially be used to map all banking instruments. An API-based open banking approach enables cross-bank and cross-company deployment scenarios in accordance with the end-to-end digitisation of banking processes.

This article in the Swisscom’ Core Banking Radar series in collaboration with the Business Engineering Institute at St. Gallen (BEI) analyses Ariadne’s approach in its “SolitX” system.

SolitX – Based on an ambitious standardisation project

The founders of Ariadne have several decades of experience in the development and sales of software for the financial industry, with an Asset Liability Management (ALM) system which has seen success all over the world.

With the know-how it has built up in the analysis of risks for banks and the standardised mapping of financial instruments, the founders of Ariadne initiated the open source project ACTUS (Algorithmic Contract Type Unified Standard, cf. www.actusfrf.org) in 2010 together with international financial market experts and on the basis of academic collaboration in connection with the Dodd-Frank Act. Since 2016, ACTUS has offered a validated, algorithmic standard – i.e. binding electronically processable instructions – as a comprehensible basis for the machine-readable processing of financial instruments. Based on the ACTUS taxonomy, 32 elementary classes of financial contracts, known as “Smart Financial Contracts”, form the data core of SolitX. Basically, a financial contract is no more than a legally regulated, prearranged exchange of cash-flows between two counterparties. Therefore, for each of the 32 financial contract classes, the derivation of the algorithmic rule is based on a consistent financial perspective.

The core innovation enabling the consistent application of the ACTUS standard is based on the following observation: Efficient, consistent mapping and processing of a financial instrument over its entire life cycle must have both the contract-specific algorithmic rule, i.e. the contract logic, and the respective contract data available for processing at all times.

Focus on Core Banking Core

Ariadne’s implementation of this observation focuses its new development on all the bank functionalities which always need to use the combination of ACTUS contract logic and contract data for the processing of financial contracts. The manufacturer calls this “Core Banking Core”, which is offered in the Ariadne solution suite with two main elements:

- SolitX for the transaction system and accounting, with a technical API layer and a DLT (Blockchain) adapter

- AnalytX for all types of risk management analyses, simulations, ALM, plus internal bank management and business planning

With the concept of a core that maps financial contracts independently of the technology, SolitX focuses on mapping the specific value-added component of financial products over their life cycle. This independence from technology also enables the use of DLT technology (Blockchain) with an adapter.

Unlike the other well-known core banking system providers, this approach does not aim to unite all functionalities in one core application, but instead provides the processing of transactions, the booking engine, the integral risk and simulation analysis and the bank planning and control instruments as core functions. As in the automotive industry, Ariadne is dependent on suppliers of different parts and software components. Unlike the other providers of neo-core banking systems, Ariadne is a Swiss product and provides the option of processing securities transactions. Other neo-core banking system manufacturers have thus far avoided these functionalities because of their inherent complexity.

In combination with what is known as the ACTUS Enterprise Data Hub, the user has the option of various views, such as customer or cash flow, on the current financial contracts.

The system is deliberately designed to be open to all other functions that can work solely on the basis of financial contract data without contract logic. The functionalities which often come with core banking systems, such as CRM, Wealth Management, KYC, AML or Payment, must be connected to SolitX in an API-based manner. The financial contracts are then controlled and executed via these linked applications.

For example, if a borrower first receives payments under a mortgage and then repays them within a certain period, these transactions follow a certain mathematical logic. The formalised contract with its instructions is available in SolitX until it is netted, and the other systems can retrieve this information.

The cash flow-based approach allows past transactions to be presented and, on the basis of the contract rules, the future transactions currently anticipated (interest payments, principal payments, interest rate changes, etc.) to be generated at any time. This allows simulations to be displayed from the perspective of both the customer and the market. It is also possible to map strategies for products, product groups or entire business areas and test them based on different market scenarios.

In summary, the architectural concept of SolitX focuses on:

- Standardised mapping of all financial products in Core Banking: The standardised, contract-oriented approach aims to shorten the time-to-market in development. Products can be configured efficiently. This will be established as a standard throughout, even beyond company boundaries.

- Combination of contract logic and contract data: In terms of the ACTUS data concept, the focus of the manufacturer is on all the functionalities that must use the combination of contract logic and contract data for processing (transaction system, booking engine, risk management and simulation solutions, planning and control systems).

- DLT (Blockchain) ready: The logic of technology-neutral financial contracts is also suitable for mapping using Blockchain technology. In addition to mapping the familiar financial products, the aim is that this logic could also be used for crypto trading or asset tokenisation. The following are examples of some of the beneficial aspects which could be developed here:

The immutability in the Blockchain enables contract security between unknown parties.

With a digitised and self-executing contract, transaction costs are reduced.

- Modular principles: There is no link to proprietary systems. The front end uses APIs to access the data architecture and contracts of the ACTUS-based core. This enables mapping of the business processes which relate to a financial contract.

- Openness and interoperability: The open platform architecture with an API-based integration concept allows user-specific configuration and high scalability. Contract information can be mapped in other applications. With the overview of all contracts, it is possible to get an overall view of all banking transactions at any time.

The basic concept of Ariadne is based on the digitisation of financial contracts.

Bank processes can therefore be mapped very individually on an end-to-end basis. The form of the banking transactions can be event-controlled and adapted to specific customer requirements. New services and business models are conceivable which go beyond the finance industry.

Usually, master data, such as customer, accounts and securities account, is created in a core banking system. Transactions, such as payment orders or share purchases, are assigned to the customer, account and securities account. This enables an overall view of individual customers and their positions. Unlike existing core banking system concepts, Ariadne’s architectural approach does not focus on customers and their transactions. Instead, the digital financial contracts form the basis of the architectural structuring. This means that the associated cash flows are triggered by the contractual mapping of the customer’s needs into individual products. This enables standardised, system-independent mapping of financial products throughout the entire life-cycle. The consolidated overall view of the individual customers and their positions is based on the composition of transactions they have effected.

Ariadne market positioning

Ariadne is currently in contact with various providers of, for example, CRM systems, portfolio management and API platforms in order to establish a stable partner network for Switzerland and thus expand its solution suite into a comprehensive core banking system with SolitX and AnalytX. The basis is always the standardised financial contract in what is known as the Core Banking Core of SolitX. This means that the concept demands a high level of integration expertise from partners in the network.

Both internationally and in the target market of Switzerland, Ariadne is initially focusing on sub-areas of existing banks and, in cooperation with partners, can take over a functional area such as the mapping of credit products. SolitX enables other providers of neo-core banking systems, which often initially focus on payment transactions, to map complex products. Emerging crypto banks and platforms are also in focus. These latter unbundle parts of the value chain (e.g. by brokering funds from mortgage platforms, securitising on platforms or mapping peer-to-peer lending).

In Switzerland and in the international markets, there are various opportunities arising from the establishment of new banks, e.g. greenfield start-ups of existing big banks wanting to deploy new technologies in a separate new unit without legacy IT burdens. Ariadne generates revenue via a traditional licensing model or an SaaS model.

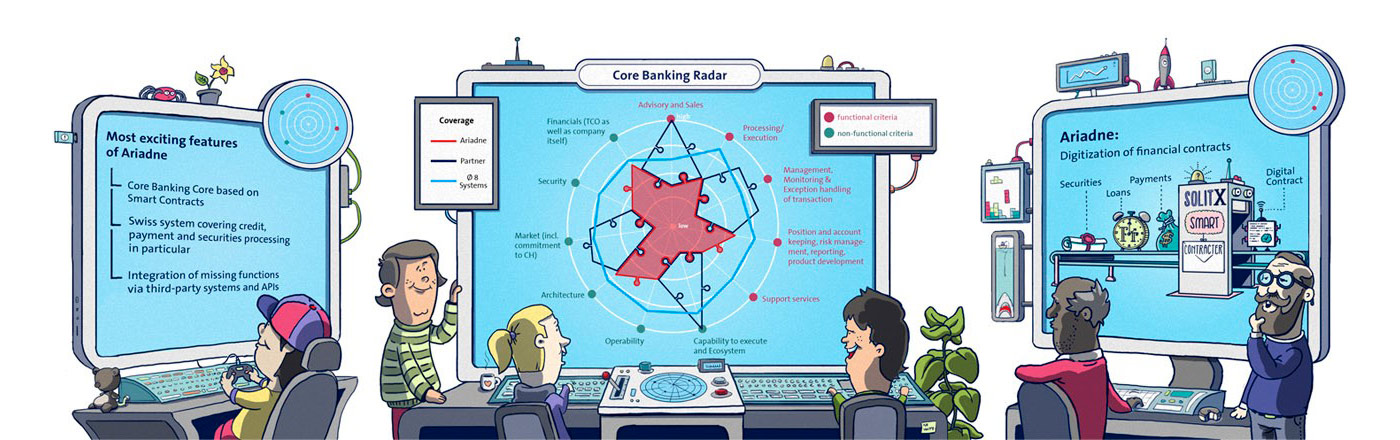

Prominent features of Ariadne.

Initial SolitX applications

Mobile First Finance, an Indian FinTech and provider of CRM, workflow and KYC solutions, is using the SolitX software on a productive basis. Their solution is put together from their own software components and some from Ariadne, initially enables end-to-end digital client onboarding and then accesses SolitX. This is intended to make the products of the affiliated financial service providers, which are structured in ACTUS format, accessible to the customer when using the mobile application.

The solution is currently being used in projects by various companies:

- Indian cooperative credit company for microfinance arrangements: The multi-branch organisation needs a robust solution for its products and customers that meets both customer mobility and core banking requirements. As a Core Banking solution, SolitX maps microfinance products in contracts, ensures transaction management and supports legally-compliant double-entry accounting. The KYC solution required for this is provided by Mobile First Finance.

- Credit institution as user of Mobile First Finance: The bank offers car loan and consumer loan financing. The customer structure requires a fully integrated, mobile application with client onboarding, a CRM workflow solution and core banking functionality for the products offered.

- Cooperation in distributed ledger technology (DLT): The founders of Ariadne have a stake in partner company atpar AG in Zurich. atpar AG also makes the ACTUS contracts available via different Blockchain variants. Initial projects and applications for the mapping, processing and analysis of tokenised crypto assets have been carried out.

Comparison with common core banking systems in Switzerland

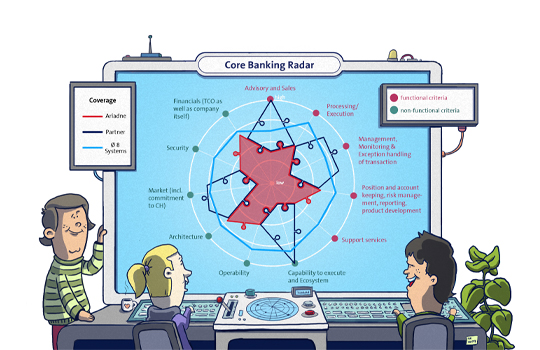

The Business Engineering Institute in St. Gallen and Swisscom Banking examined all common core banking solutions as part of the Core Banking Radar. Because of the architectural approach of SolitX, which focuses on mapping financial contracts of all kinds, this comparison of the functional coverage gives an insight into the areas in which SolitX needs to cover functions by means of cooperations.

The functional coverage differs greatly between today and the target in 12 months, as the system is still under construction. If we look at the horizon over time, the functional coverage is characterised as follows:

- Sales and consultancy support: As Ariadne relies on the integration of external systems such as consultancy support, online banking and CRM, this adds little to the characteristic profile. The direct data entry option currently available is very basic. The coverage with integrated peripheral systems should include the normal functionalities of a CRM within 12 months.

- Execution and processing: Currently, the system covers the basic functionality for execution and processing. It is to be significantly expanded over the next 12 months.

- Handling of transactions (plus cross-transaction view): Monitoring and management are still only barely covered. Here, too, significant progress is to be made over the next 12 months. However, the product-focused architectural approach must be taken into account. Comprehensive position views, legitimisations, reconciliations and pledges are covered by peripheral systems on the basis of logic. In SolitX, positions can be generated through the cash flow view based on contracts. This means that functions based on it which access all transactions, such as balance sheet analysis, risk management, ALM and business planning and simulation, are comprehensively supported in the AnalytX subsystem.

- Support functions: Because of the architecture, accounting functionalities are covered in detail. In the future, the focus will also be on business process management and documentation.

Comprehensive banking services relating to payments, brokerage & trading and financing are also still being developed in SolitX. First, ACTUS products are implemented in accordance with the defined standard. Currently, only rudimentary payment transaction functions are covered, as are credit types, via the logic of contracts. In 12 months, there should be functional support for the current products in securities trading/brokerage. Comprehensive marketplace functionalities, such as crowd-funding, are not yet planned. Basically, the 32 financial contract classes offer the possibility of creating in-house products or combining existing products within these classes via parameterisation in SolitX.

What Ariadne offers compared to with the systems already examined.

If the non-functional properties of the system are considered, the following picture emerges:

- Architecture and operability: The open approach of the architecture, with standardised financial contract types as the basis for flexible product mapping, provides efficient and stable operability. For example, the technology independence enables flexible design of the database and operating environment. If required, this is also possible based on Distributed Ledger Technology (DLT). The approach also demonstrates high levels of scalability and is flexible in terms of parameterisation. The system is cloud-ready and supports container-based operating models.

- Market: As this is a Swiss product, it does not require adaptation to the Swiss market. However, there is a lack of reference installations in Switzerland. In the evaluation, this is shown by the low level on the diagram.

- Security: The functions and concepts are still under construction. Principles such as data anonymisation or identity management are in place.

- Financials: The basic architectural concept promises low development costs and low costs for the customer. However, it should be noted that only a specific and rather small part of the functionality required by an average Swiss bank is supported by SolitX. The integration of different providers is necessary to cover the entire bank functionality.

Ariadne builds on the development of ecosystems with partners. Ariadne relies on the idea of integrating third-party systems. Ariadne operators will cover many topics, such as CRM, portfolio management and financial planning with third-party systems.

However, the integration of third-party systems means the management of integration projects and expenses. There are many functional areas that are covered by peripheral systems or existing core banking systems. Ariadne should not be seen as a standalone core banking system, but rather as a linking system with the ability to manage and process contracts in a consistently standardised manner. This allows comparable coverage of functionalities, as in the eight core banking systems already examined.

A potential challenge in the implementation and application of SolitX will be consistent compliance with the ACTUS standard when mapping even complex products and product bundles. Initial operational tests have shown that this data architecture enables high-performance operation.

Smart Contracts as a new concept for Open Banking?

Open banking and open platforms are changing the face of the finance industry. The idea of customer journeys and end-to-end digitisation for the end customer forces those involved to develop cross-company concepts. Open Banking is a buzzword that is on everybody’s lips, meaning a fundamental rethink in system support for the financial industry.

This leads Actus to its central idea that the mutual exchange of information and money flows between the stakeholders is based on algorithmic rules in the form of digital financial contracts. This means that transactions can be processed on a centralised or decentralised basis via banks or other companies. It doesn’t matter how: All stakeholders are familiar with the individual financial contract, with its rules, data and transactions, throughout its entire life-cycle. Analysis, risk management, accounting, controlling and reporting can be supported by it.

The following three cross-company deployment and usage scenarios are theoretically conceivable in the interaction between FinTechs, banks, operators and companies outside the industry:

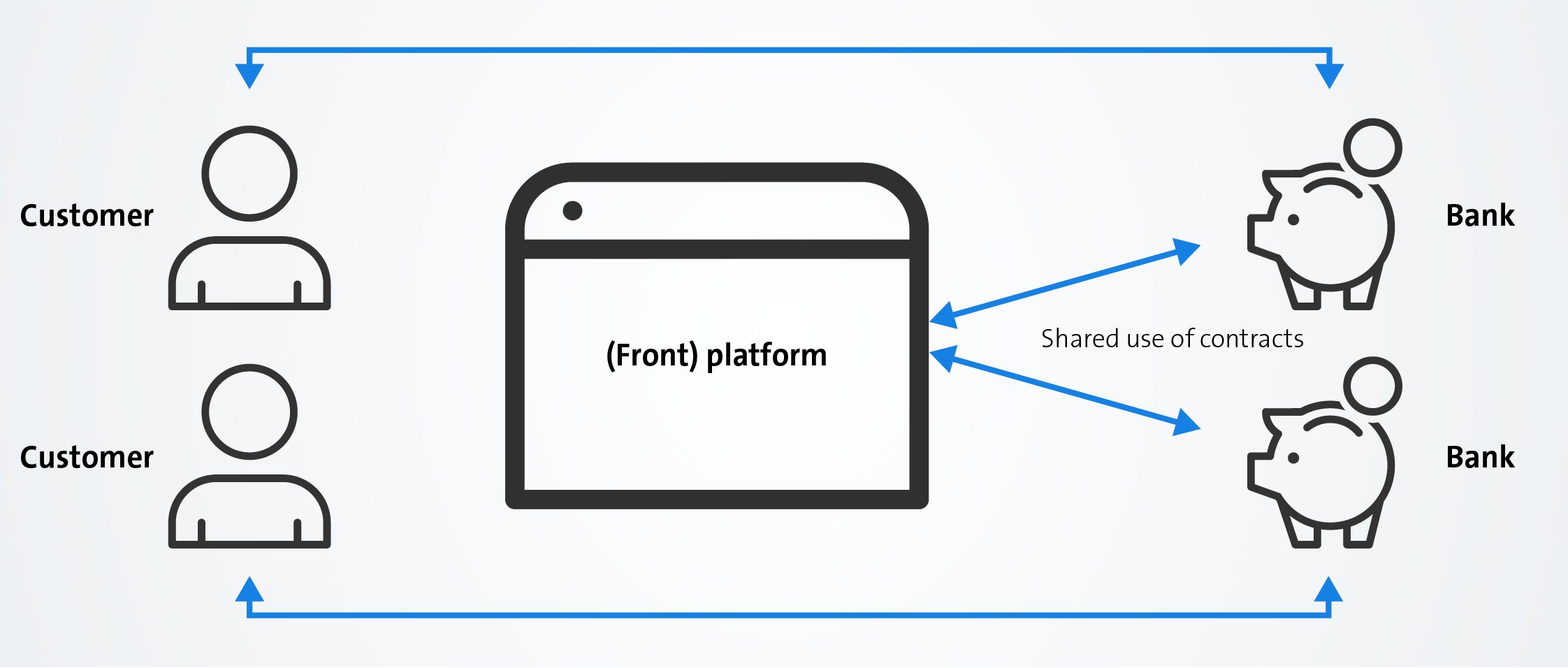

Scenario 1: Exchange of contracts

Banks and other participating companies use the same contracts and accompany the customer along a joint customer journey. For the customer, this takes the form of individual services.

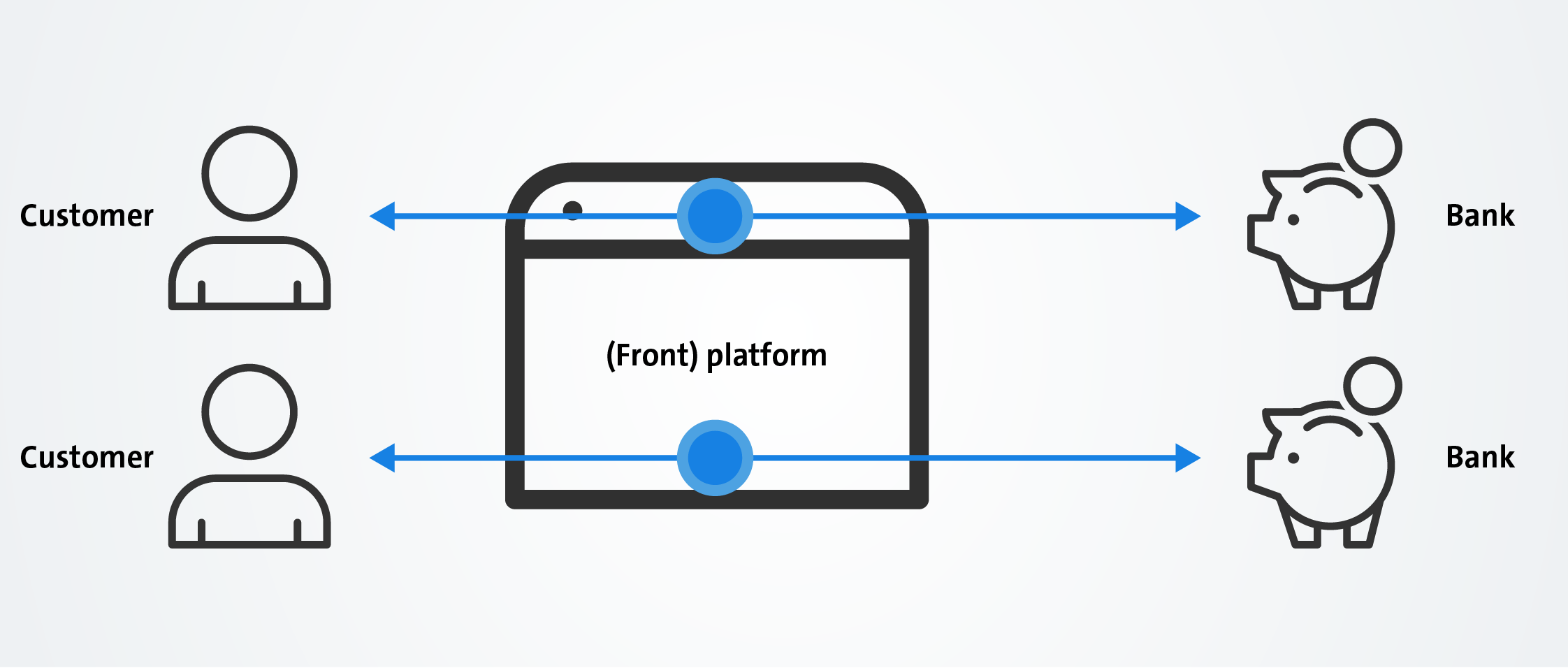

Scenario 2: Cost sharing

Banks share a common platform for selected banking services, which they present in the form of standardised contracts.

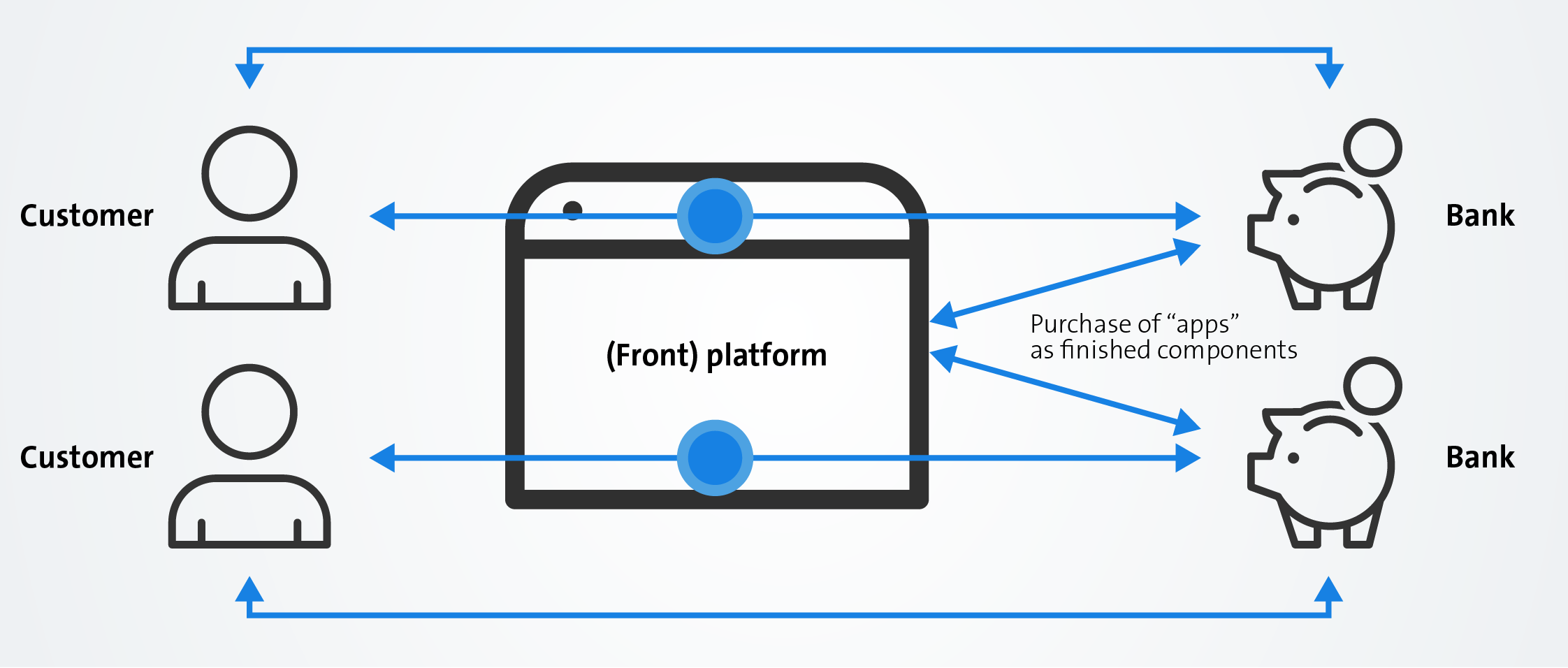

Scenario 3: App Store model

Companies provide their products on a common SolitX platform based on the uniform standards of ACTUS. Processing is carried out by different companies. The services of individual companies can be provided consistently in accordance with the Customer Journey.

Conclusion – Is SolitX with Smart Contracts a new concept for the banking of the future?

The challenge for banks lies in developing a viable strategy for future system support. The opening of the systems is a central issue for all manufacturers. Start-ups and FinTechs provide solutions in increasingly central areas of the finance industry. Cross-sector networking as a component of new business models is already a hot topic and is discussed under the heading of “Ecosystems”.

In all probability, the solution for many to this challenge will not lie in replacing the core banking system and a renewed wave of traditional migration projects. These high-risk projects eat up tens of millions of euros and tie up financial and personnel resources that could otherwise be used for market-oriented further development.

The concept of product development by means of platform-independent Smart Contracts supports opening up in line with Open Banking, modularisation with a focus on service and cross-company networking based on the ecosystem concept. All three developments are adopted by Ariadne in their SolitX solution. Unlike other new systems, which have their roots in retail banking and thus in payment transactions, Ariadne already covers extensive services in the financing and securities business. There should be no issues with adapting to the Swiss market as the solution comes from Switzerland. The partner-based approach of SolitX also meets the current trend: The core banking system consists “only” of a solution for the processing and booking of transactions or, in the case of SolitX, of Smart Contracts. All other functions, such as consulting support, online banking, CRM and even transaction monitoring are solved in specialised peripheral systems.

With this approach, Ariadne promises future-driven modernisation of the current system support of banks. The Core Banking Radar will continue to monitor developments.

Company profile

Name: Ariadne Business Analytics AG

Founded: 2015

Head office: Zug

Founders: Willi Franz Brammertz, Wolfgang Breymann, Nils Bundi, Daniel Imfeld, Shirish Kumar, Jeff Braswell

CEO: Willi Franz Brammertz

Employees: 18 (incl. Hyderabad)

Further development locations: Nänikon (ZH), Hyderabad (India)

First delivery: AnalytX: 2017, SolitX 2019

Sources of revenue: Software rental, consulting

Ownership structure: AG Shareholders = (all involved)

Business Engineering Institute St. Gallen

Swisscom and the Business Engineering Institute in St. Gallen (BEI) have been in partnership for many years within the framework of the "Ecosystems" expertise centre. The centre works with topics such as ecosystems, digitalisation, transformation and matters pertaining to the future structure of the financial industry. Along with its research activities, the BEI runs projects designing and implementing innovative, cross-industry business models.