‘The new CIAM solution has made e-banking even more secure.’

Baloise Bank’s new secure e-banking solution supports state-of-the-art CIAM. Swisscom set up the system in a short space of time and operates it reliably around the clock.

Secure e-banking system with CIAM and a web application firewall 3 Min.

- Headquartered in Solothurn

- Approx. 400 employees

- Approx. 120,000 customers throughout Switzerland

- Planning and setup of the new e-banking system

- Secure customer management with Customer Identity and Access Management (CIAM)

- 24/7 protection from the web application firewall (WAF)

Is it better to modernise an existing e-banking system that is more than 20 years old or start afresh with a completely new solution? For the Baloise Group, the choice was clear: a powerful, flexible e-banking system with modern authentication methods was key to strengthening its position as an integrated financial services provider with banking and insurance. So, a new build was the answer!

A brisk pace for implementation

To set up the new e-banking system, Baloise called in Swisscom. Heinz Bader, Head of IT Services and Member of the Board of Directors, gives a rundown of what was involved: “The project launched on 1 May 2023. Between April and the end of June 2024, we migrated all our customers to the new e-banking and CIAM platform in waves. We did not experience any bottlenecks or outages. The challenges were considerable. Our core system runs in the Group’s data centre, while the e-banking platform runs in the Swisscom data centre. Connectivity was therefore essential. The interplay between us, Swisscom, the platform supplier and other partners was also complex. When we needed a development environment ASAP, Swisscom really stepped up. The pace of implementation was very brisk. Today, we can confidently say that quality, time and costs were all spot on!”

Heinz Bader and Rolf Vogt (application management team leader, right) are delighted with the rapid implementation of the new, highly secure e-banking system.

A neat solution: Customer Identity and Access Management (CIAM)

Until recently, customers had to use photoTAN to sign into e-banking with Baloise. Today, the process is much more straightforward. The new CIAM solution also enables 2-factor authentication on the smartphone using fingerprint and face ID. “With the new CIAM solution implemented by Swisscom, e-banking is even more secure,” explains Heinz Bader. “It meets the Group’s rigorous security requirements. Having Swisscom manage the CIAM and web application firewall is extremely helpful – we simply do not have the resources to do it ourselves.”

E-banking with security as a service reduces the workload

There are only 23 employees in the bank’s IT team. Due to a new configuration of services within the group, the team had to take on additional responsibilities, making the already minimal resources for e-banking operation even scarcer. “What we need is a 360-degree, 24/7 service that we cannot provide ourselves,” says Heinz Bader. The bank already had a positive experience with Swisscom as an outsourcing partner for TWINT and CardX operation. But that was not the only reason outsourcing the entire e-banking business to Swisscom was a logical step, as Heinz Bader explains: “We learned about Swisscom’s competence in the e-banking and security environment from other banks. As the largest player in banking system outsourcing, its experience and qualified specialists are second to none. We were won over by the whole package, but especially the freedom we were given in the choice of services. The cost was also right.”

Everything under control 24/7

Heinz Bader and his team highly value Swisscom’s managed services for e-banking. As he explains, it cannot be taken for granted that everything will go according to plan because, “It’s complex! We have different systems that need to work together in a hybrid architecture: on premise, in the cloud, SaaS models. Managing the different interfaces is probably the biggest challenge. Swisscom has proven to be a reliable partner, especially with troubleshooting.”

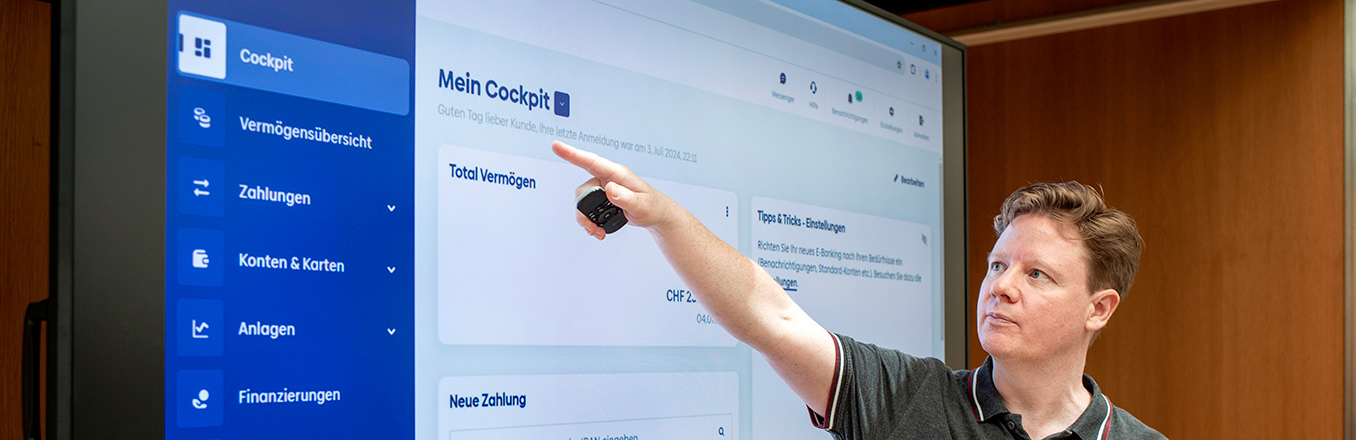

Philip Stadelmann (standing) successfully managed the complex new e-banking project as project lead for the bank.