Core Banking Radar

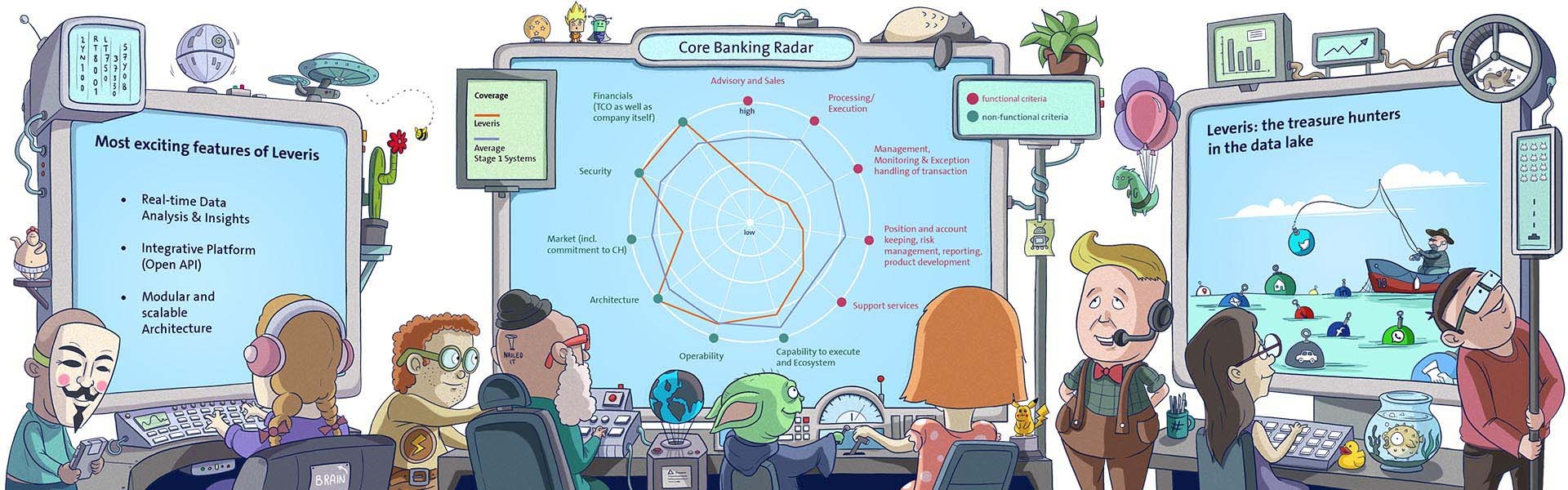

Leveris: Banking support is central to the digital ecosystem

The Irish manufacturer Leveris has built a new core banking platform from scratch. This platform, which is presented here by the Core Banking Radar of Swisscom and the Business Engineering Institute St. Gallen (BEI), puts banks at the core of digital ecosystems, thus paving the way for new, data-based business models.

Text: Matthias Niklowitz, Images: Zense, 23 august 2018

For many less affluent customers, the account management fees are one of the most important arguments speaking for or against a banking relationship: In these times of low interest rates, customers are feeling the impact of these fees, and consumer protection organisations and broadcasts also regularly focus on this topic. From the bank's perspective, the income generated by the account management fees must cover the costs of customer acquisition and customer retention. Quite often, these fees can also replace the income lost on interest operations.

But the latest developments are blowing up this connection, paving the way for a new solution to the problem of high fees chasing customers away: The targeted (and hopefully discreet) use of customer data as a source of revenue.

This does not refer to the kind of data usage exercised by Google and Facebook, but rather to the management of customer data within a bank and customers' explicit participation in the usage of their data, which is handled in compliance with the most recent European regulations and data privacy obligations.

Banking for end customers

It is becoming clear that the introduction of systems such as the Leveris solution will allow bank customers to choose whether they wish to be compensated for the usage of their data with a lower account management fee. If the databases are exploited in full, it might even be possible for bank customers to earn (small) amounts in the form of additional interest or digital vouchers for selected offers.

That Swiss banks are not yet actively focusing on the usage of their data in order to create a new business model is not necessarily due to a lack of motivation or understanding of the opportunities on the part of their top management teams. Rather, they often do not have the IT systems they would need for such a step. Open API approaches can solve some of the immediate technological challenges of linking powerful data processing and analytics systems to a bank's core banking system, ensuring the basic technical viability of the kind of data usage described above against suitable compensation for the customers. But there are still fundamental hurdles when using common core banking systems, such as time- and resource-consuming release cycles, taxing innovation projects, expensive upgrades and scalability restrictions.

Challenges for manufacturers

The selected strategic challenges facing manufacturers of core banking systems in further developing their own systems to meet the needs of their customers' future business models include the following:

- Keeping the total cost of ownership (TCO) down: Implementation of an end-to-end standard solution that can be applied for all customer banks while still allowing for individualisation where the customer bank requires differentiation. Achievement of a high STP (straight through processing) rate and avoidance of manual intervention, through automation whenever possible.

- Modernisation: Binding strategy and manageable road map for refreshing the current system landscape. This means, among others, selecting the right modular structure and entering into partnerships, as adjustments to the current system prevent consistent restructuring and lead to growing complexity (complexity trap).

- Market positioning: Consideration of end customers with new concepts such as customer journeys (understanding of and support for customer requirements and activities) and the focused expansion of added-value services with selected partners so that the own system support does not degenerate into an exchangeable service (lock-in by creating an ecosystem).

Back to the gearshifts

Leveris, a provider of core banking systems from Ireland, has its own approach to finding solutions for these challenges.

Keeping TCO down: For example, Leveris reduces the operating costs by consistently processing transactions in real time, which eliminates the need for batch processes. The decoupling of modules in the Leveris architecture and the continuous software delivery process eliminate expensive release and regression tests.

Modernisation: Leveris follows the approach of a lean core banking system offering the most important core functions while all other services are provided via APIs. This even applies to near-core functions such as securities handling, which is done by freely chosen peripheral systems. The core itself and the peripheral systems offered by Leveris have a modular structure, while a microservice architecture ensures that they are decoupled from one another.

Market positioning: The Irish company, which by now employs more than 150 people, defines its role as an enabler for banks, which should be made the centre of digital ecosystems and market places. Through its central data storage Leveris enables hook-ups with customer journeys or the actual ongoing activities of customers and the direct interlinking of end customer requirements. To this end, banks' cooperation with other banks and fintechs should be simplified across the industry. The bank at the same time retains one of its most valuable assets: Access to customers and their data via Leveris's data lake – sort of a large data pool that integrates internal and external data.

Leveris processes internal and external data from its data lake.

Five essential modules

The main features of the Leveris approach are implemented via five modules in the retail banking suite:

- Banking core: The central posting engine providing the basic functions for a retail bank comprises a master data model and offers a uniform customer view. The core is based on an Oracle database. The central logic of Leveris is written in PL SQL, a program language for these databases. Leveris explains this choice with the unique stability and performance of the Oracle solution. From the perspective of the Core Banking Radar it is interesting that the technology which has been used in the core by Avaloq and Finnova for many years was also selected for a neo-core banking system.

- Payment hub: In contrast to other providers, Leveris classifies payments as an important feature which a bank definitely should control itself, but not necessarily process itself (also because it enables further services and data analyses). The module stands outside the core system, is linked via API, and with its parallel synchronous processing architecture it can also process large volumes of data.

- Data science hub: Leveris sees the collection and adequate usage of data as a core competency. Transactions and other events are stored in real time as a copy of the core master data in the data science hub for analysis purposes and are processed in real time via artificial intelligence and machine learning.

- Operational excellence: Based on the data science hub, this allows the measurement of processes, simulation of scenarios (e.g. the impact of digital marketing measures) and business results; can also be linked to the components or services of third-party providers.

- Channels/interfaces: This is the instance used to link third-party systems via APIs in order to offer customers pleasant experiences with integrated bank services.

These five modules can be freely combined in accordance with the bank's wishes and requirements, but the core is always part of the solution.

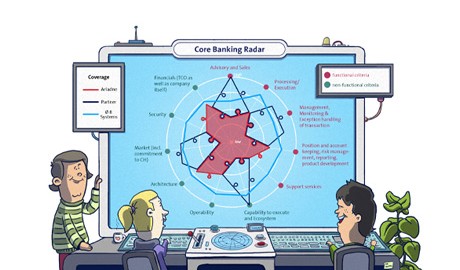

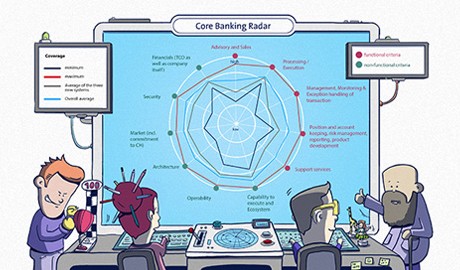

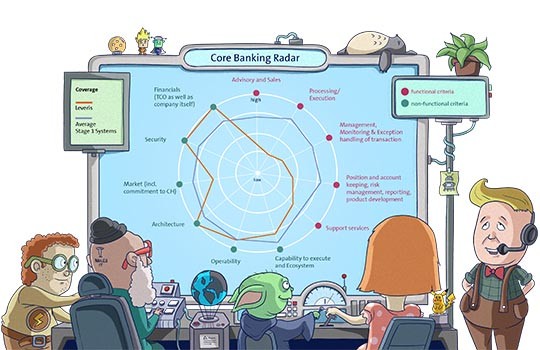

Comparison with popular systems in Switzerland

For the Core Banking Radar, the Business Engineering Institute St. Gallen and Swisscom Banking compared the Leveris offer (without peripheral systems) with the systems that were investigated in spring 2018. They identified some functions where the Leveris solution is further ahead than other providers. These include:

- Integration and operating costs: The integration costs are very low in a comparison, while the operating costs (comprising the licence and service fees) are judged to be "very low" by the Core Banking Radar. However, the integration complexity and the fact that many external providers still have to be linked could drive up these costs.

- IT security: There are permanent security tests, and all customer-related data can be anonymised without exception.

- IT architecture/interfaces: The interface concept is very mature, the open API concepts have been fully implemented, the tests can be run entirely automatically, and the performance and scalability are judged to be "very high".

The Leveris solution (without peripheral systems) compared to the systems that were investigated in spring 2018.

The following are below the average for other providers:

- Sales and advisory support. As Leveris relies on the integration of current providers, it receives lower marks for its proprietary system.

- Execution and processing: The execution and processing of payments and loans are covered by the standard system. Securities processing is done by peripheral systems.

- Transactions (including cross-transactions): The core functions of a retail banking system (items and accounts) are handled very well by the payments and financing modules. Investments are processed via peripheral systems.

In general, Leveris specifically favours the docking of peripheral systems in areas where it currently (and partly also in future) does not offer its own modules, (also) because these do not promise any added value.

Users of Leveris solutions therefore have to accept that some topics are covered by third-party providers, which makes it more difficult to compare the total costs of the solutions offered by the different manufacturers. This in particular includes the investments module, as Leveris with its system designed for Anglo-Saxon retail banks does not anticipate the in-house processing of securities transactions.

However, Leveris is working with a large solution provider to develop an integrated investment solution.

Accumulating expertise

At present, Leveris is earning a financial income from implementation and software-as-a-service fees. In future, fees should also be earned for the integration of third-party products (for the marketplace approach) and the monetisation of data.

According to its own statement, Leveris will earn revenues in the lower double-digit millions in euro this year, and this is expected to more than double in 2019. The first two implementations of the Leveris system is a P2P platform in the Czech Republic and a mortgage platform in the Netherlands.

At present, a digital private bank based in a country in Western Europe which intends to expand into five further European markets after it goes live in Q1/2019 and an Austrian digital private bank are being implement. Leveris is also working on a fully digital loan and mortgage application process for the UK and Irish markets. More banks are showing great interest.

According to its own statement, Leveris has global ambition and wants to become one of the top ten providers of core banking systems. Its target groups include all banks (incumbents, challengers, neobanks). Customers can choose whether and how they operate their Leveris solution (e.g. on premise, in private clouds or on the public clouds of Amazon Web Services (AWS) or Microsoft (Azure)).

The adaptation of the Leveris system to the specific requirements of Swiss customers is not very advanced yet: At present there are no developer resources or reference installations in Switzerland (or the DACH region). Because of its flexible and open architecture which simplifies the modular integration of local solutions as well as the experiences made with three nationalisation projects to date (EU / SEPA countries), Leveris itself expects manageable additional expenditure for tailoring its core banking solution to Swiss requirements. Leveris is also actively marketing its product in Switzerland and indicates that discussions with prospects in Switzerland are in an advanced stage.

Outstanding features of Leveris.

This allows the following conclusion: From the perspective of Swisscom Banking and BEI, Leveris is a promising upcoming provider of a core banking solution that convinces with a mix of innovative technologies (microservices, real-time system, open API and data lake) and traditional approaches (Oracle and PL SQL technologies). The consistent integration of third-party providers is a forward-looking approach in view of a possible future development where ever more functions will be covered by peripheral systems and the core banking system will primarily be a posting system.

A unique feature is the importance given to the data level, which is expressed by the storage of data at a central point and the event-based real-time integration options in the customer journey. With this new campaign management organisation, Leveris wants to help banks take centre stage in the digital world as an integration platform rather than having to play a subordinate role as processor on the outskirts of digital ecosystems.

Effective usage scenarios

Other strong points include the modular approach which allows a fast pace of development and the acceptance of various future banking concepts, e.g. a marketplace bank or a mobile bank. It should be noted, however, that the integration complexity has to be actively managed here if the targeted low total cost of ownership (TCO) should not be jeopardised by a high degree of architectural complexity.

The open architecture means that the bank must have an expanded architectural perspective and IT expertise in order to manage the interfaces. This also includes knowledge of the processes and developments in the digital ecosystem outside the banking world. This is the only way in which a platform like this one developed by Leveris can be meaningfully exploited in full.

The establishment and management of the end-customer relationship will become ever more important for a bank's business success in future. At present, a tool such as Leveris cannot replace any existing core banking system in Switzerland on a one-to-one basis.

However, Core Banking Radar recognises two scenarios where this solution can be used effectively: First, to replace some functions for current banks, which could initiate a progressive change. And second, for a new bank or some business lines in the form of focused new start-up business models, expanded by incentives for the progressive migration of the customers to a neobank.

Core Banking Radar will keep a close eye on future developments.

Company profile:

Name:

Leveris

Founded:

2014

Head office:

Dublin, Ireland

CEO:

Connor Fennelly

Employees:

More than 150

Other development sites:

Prague, Czech Republic and Minsk, Belarus

First delivery:

May 2017

Revenue sources:

Integration, licence and service fees

Development phase:

2014 to 2017: Development

2017 to 2019: Various B2B implementations

From 2019: Scaling by implementations in strategic partnerships with typical system integrators (B2SI)

Shareholders:

Privately owned company

A serie-A round took place in 2Q18

Swisscom and the Business Engineering Institute in St. Gallen (BEI) have been in partnership for many years within the framework of the "Sourcing in the Financial Industry" expertise centre. The centre works with topics such as ecosystems, digitalisation, transformation and matters pertaining to the future structure of the financial industry. Along with its research activities, the BEI runs projects designing and implementing innovative, cross-industry business models.

Newsletter

Would you like to regularly receive interesting articles and whitepapers on current ICT topics?

More on the topic