Digital benchmarking for Swiss and Liechtenstein private banking

A new study provides insight into today's status of private banks' digitalisation initiatives.

Find out more about how you can become part of the study community.

February 2024, text: Simon Ruettimann, Prof. Dr. Anjeza Kadili, Dario Tam 4 min.

Benchmarking the digital transformation: e.foresight's study series in private banking

In order to provide an overview of the current status of the digitalisation of the customer interface in the Swiss and Liechtenstein private banking market, e.foresight (a Swisscom trend scout of the banking industry) launched a recurring benchmarking study. This was created in collaboration with the Haute école de gestion Genève (HEG) and the Institut Supérieur de Formation Bancaire (ISFB).

Future functionalities in private banking: a digital benchmark in Switzerland and Liechtenstein

The e.foresight Digital Private Banking Benchmarking Study analyses the current and future functionalities covered by the client interfaces of private banking players operating in Switzerland and Liechtenstein. The relevant functionalities in e-banking, mobile banking, and advisor application (i.e., applications used by advisors for physical customer meetings) are analysed via a systematic questionnaire completed by participating banks. The survey includes both pureplay wealth managers and private banks, as well as universal banks operating in the private banking segment.

Shape the future of private banking in Switzerland and Liechtenstein with the latest digital trends and strategies. We will clarify your needs and make you a customised offer.

The most important findings of the study:

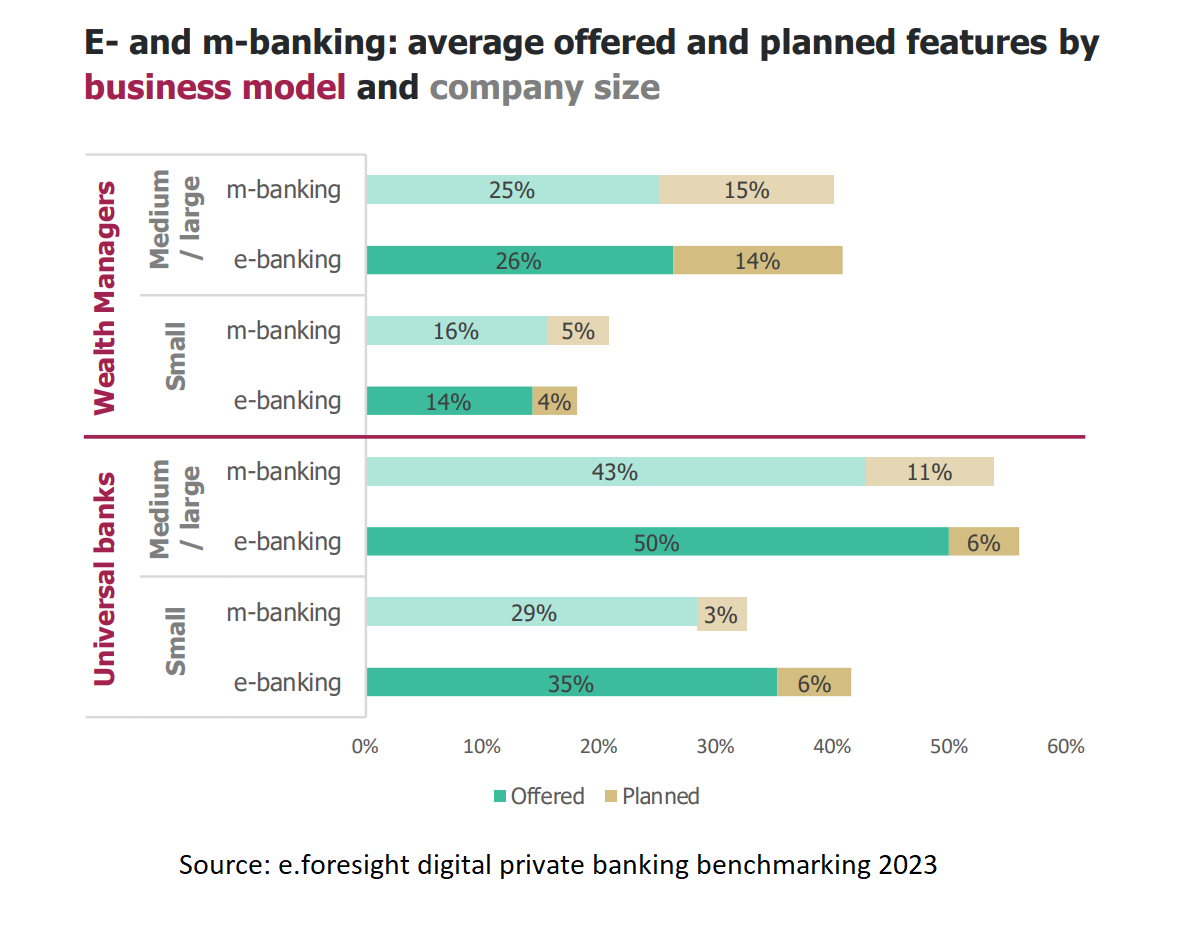

Low functionality coverage requires catching up

With an average functionality coverage of 32% across all customer interaction channels, there is currently significant potential for further digital developments. While today’s digital customer interfaces in private banking primarily cover administrative features, their importance for core asset management services will increase. This particularly includes digital functions that support discretionary and advisory mandates.

Big plans for medium and large asset managers

Hybrid vs. physical interaction model

Digital sustainability features

For private banks e.foresight offers up-to-date analyses, studies and consulting formats that provide strategically relevant insights into innovations in global and Swiss wealth management. Find out more on how to become a member.