Regulatory compliance and banking IT compliance

Regulatory monitoring for efficient banking compliance

Changes to regulations such as money laundering or data protection rules place high regulatory demands on banks.

The changes often affect IT systems and processes. Banks and providers must therefore recognise the implications at an early stage and may need to modify their applications.

When is it the right solution?

Our regulatory monitoring service is primarily aimed at Swiss banks that work with Finnova. Thanks to our service, they can reduce the workload of their in-house monitoring and/or banking compliance departments and implement regulatory requirements efficiently, effectively and on time.

The next step

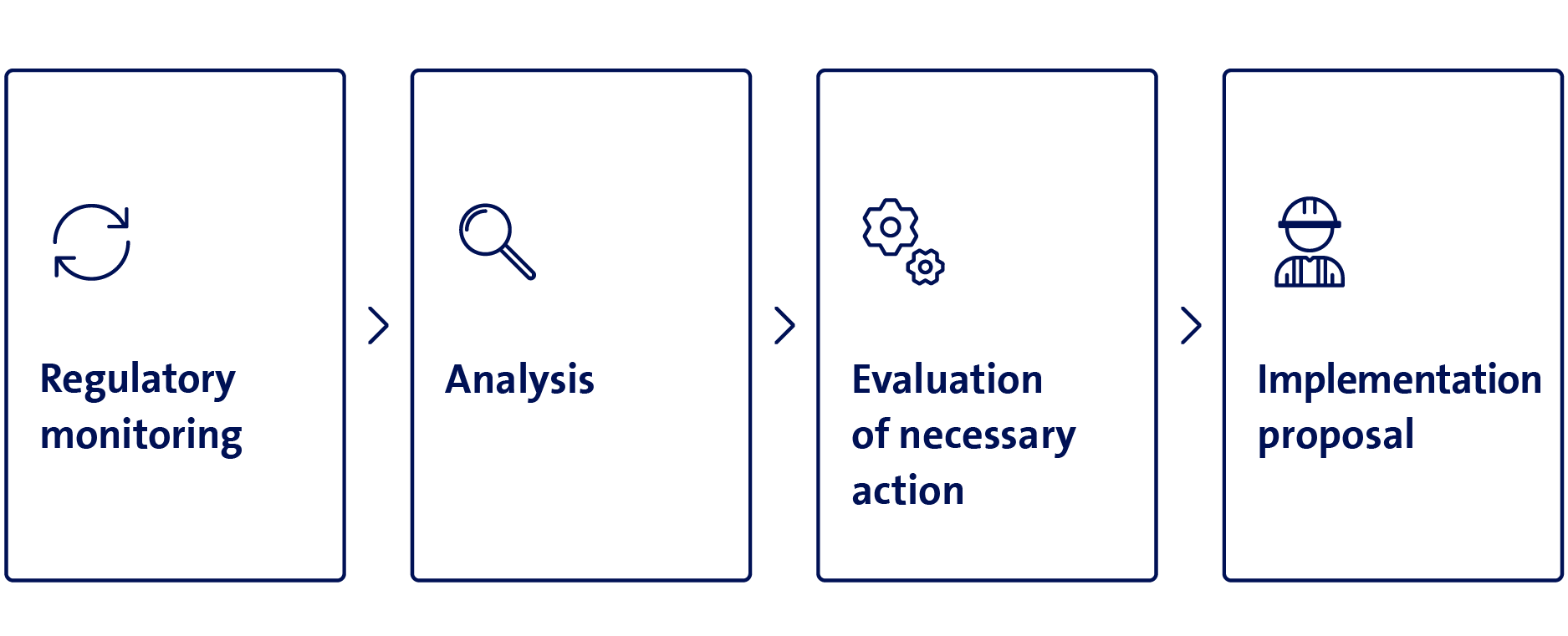

Procedure

Reduce the workload of your compliance team

We monitor regulatory developments, analyse their impact and assess whether the requirements can be met with existing IT and processes.

If not, we analyse the needs and develop implementation proposals for

our software partners so that banks can comply with the requirements as

quickly as possible.