Hybrid Client Onboarding for banking

Client Lifecycle Management in today’s banking

Product including climate contribution

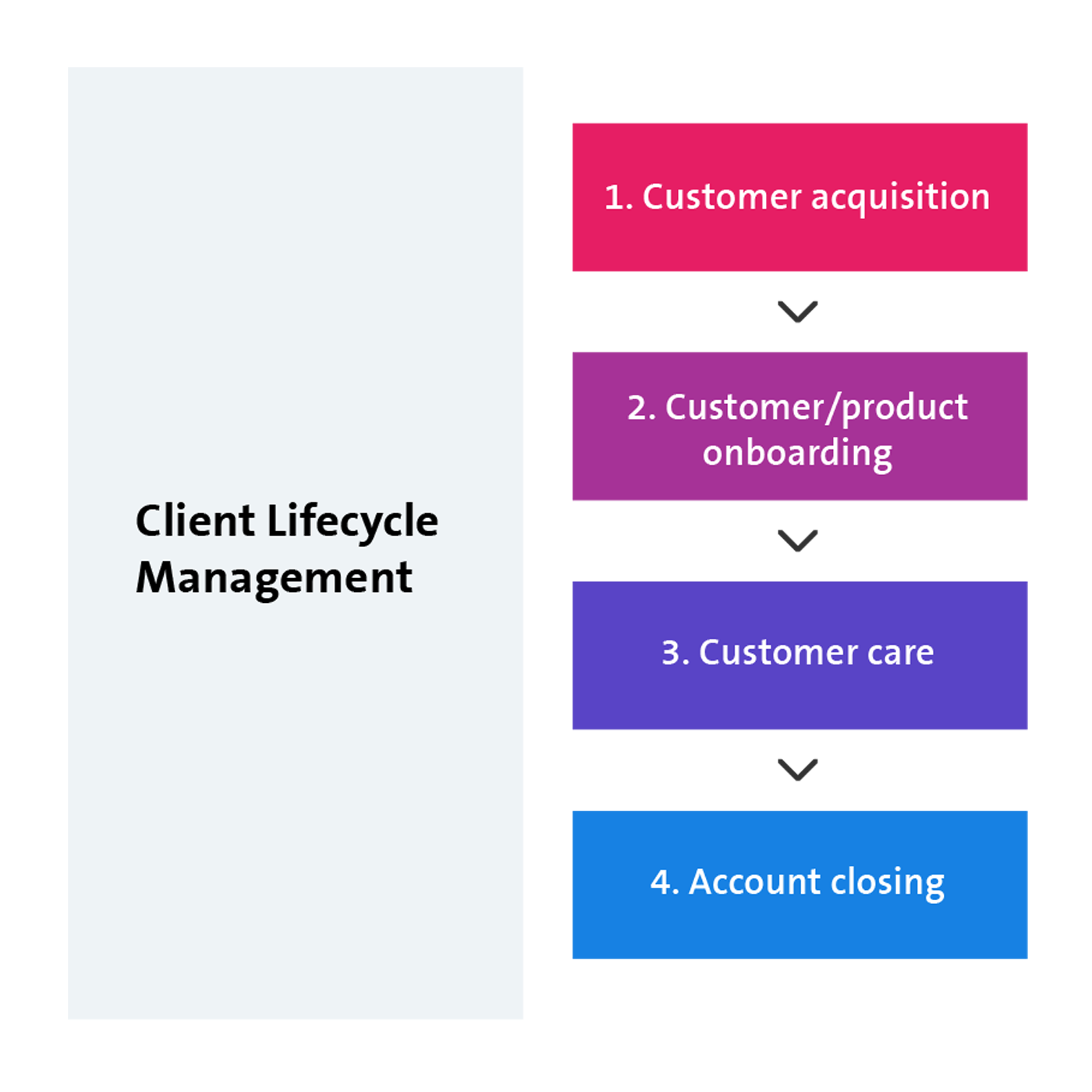

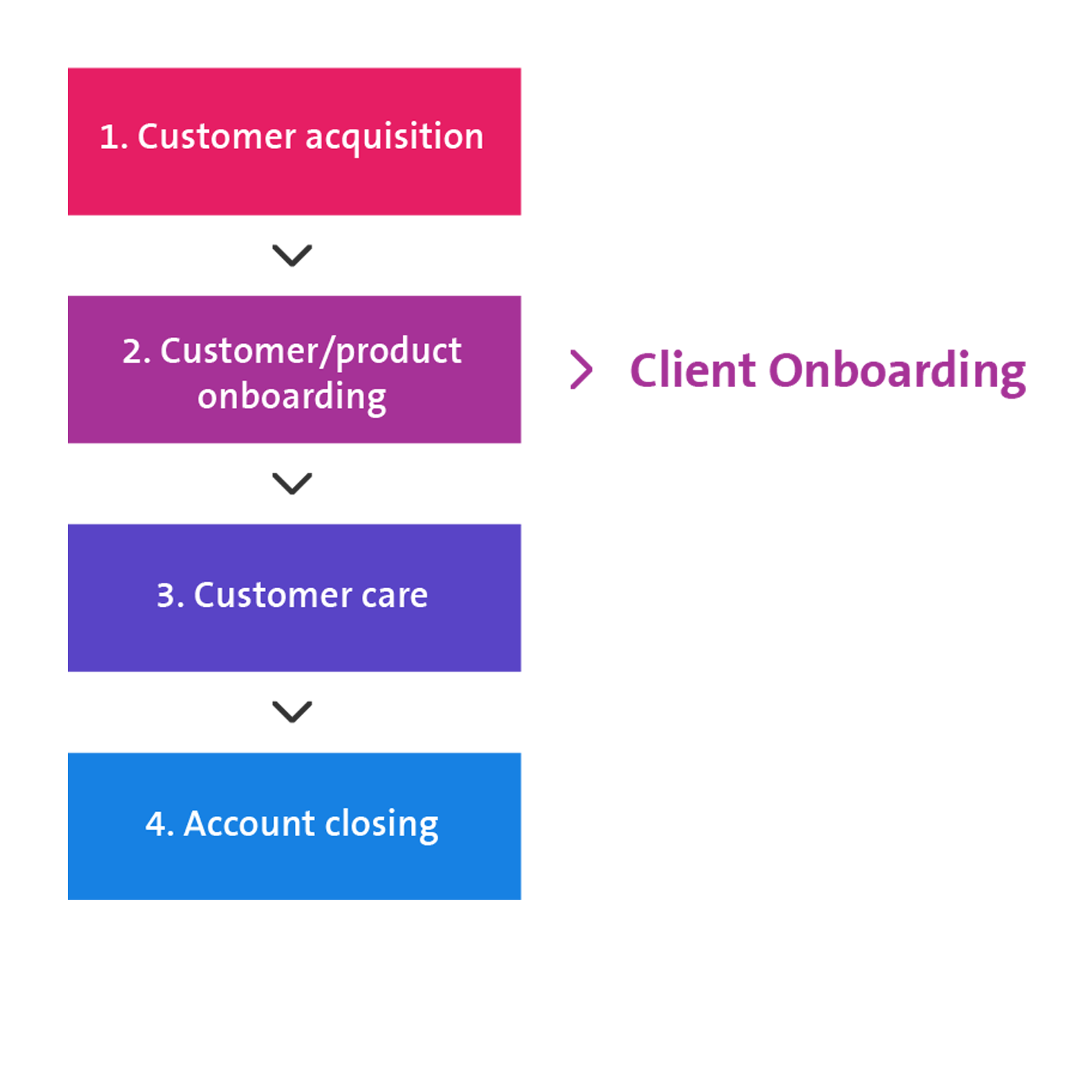

Client Lifecycle Management (CLM) maps the entire banking client lifecycle. From digital Client Onboarding and support to account closing.

With our hybrid Client Onboarding process, bank customers can take out products or initiate relationships at home and/or in the branch. Continuous, paperless and seamless.

When is it the right solution?

Client Onboarding is the hybrid solution for new customer acquisition and is independent of time, place and device. It digitises and standardises processes, automates tasks in the front and back office, uses both the in-branch and self-service channel, improves the efficiency of processes and increases security.

Client Onboarding quotation

Additional information

Downloads

The biggest advantages for you

Client Onboarding Banking

There are several benefits for your customers. Firstly, they are able to open accounts or take out products quickly, around the clock and without any physical paperwork. Secondly, they can access their accounts and use all services as soon as they have digitally signed the application.

Application examples

Hybrid Client Onboarding

In branch and/or at home

Hybrid Client Onboarding from Swisscom covers the entire onboarding process. The system guides users securely through every process step on a workflow basis, automatically checking all data and preparing it for the back office and compliance department. Thanks to the hybrid approach, you can switch between the branch and self-onboarding channels at any time.

For example, the customer advisor starts the client onboarding, records all KYC data and discusses possible products with the new customer. The customer needs more time to make a decision. In the evening at home, the customer continues the onboarding started by the consultant, selects products from the product universe, completes the integrated online identification and finalises the client onboarding independently.

Of course, you can also start the other way around or switch between channels several times.

A document set is generated for each use case.

Possible products and banking services:

- Payment accounts (CHF/EUR private accounts)

- Savings accounts (CHF/EUR, young people/children)

- Pension accounts (savings 3a/third pillar)

- Bank and Maestro cards

- Credit cards (CHF/EUR)

- Prepaid Mastercard

- Product sets/account sets

- E-banking with signed account opening documents

Integration

within the website and/or banking processes