Banking Process Outsourcing

Reduce costs and optimise services with Banking Process Outsourcing

With Banking Process Outsourcing from Swisscom, you can outsource important but time-consuming tasks or standardised processes.

For example, securities and payment transactions, securities masterfile management and document digitisation. This gives your employees more time for value-adding tasks, such as advising customers.

When is it the right solution?

Banking Process Outsourcing is designed for any bank facing a know-how shortage due to employees resigning or retiring, or wanting to reduce its staffing costs. Take advantage of our knowledge and experience while you focus on your core business.

Get started with Banking Process Outsourcing

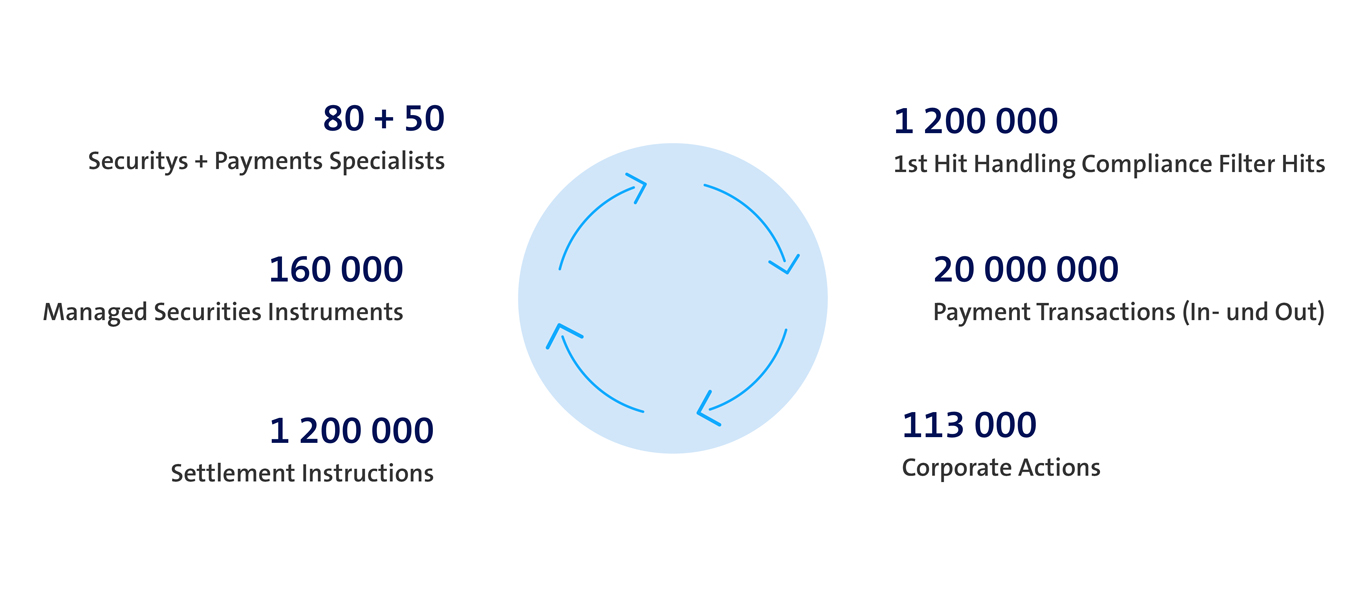

Banking Process Outsourcing in numbers

Our Banking Process Outsourcing services

Payments

We standardise and automate payments

- Flexible employees guarantee same-day processing despite fluctuating volumes

- Broad specialist knowledge and established contacts network facilitate enquiries

- Experienced processing experts prevent fraud attempts

- Our “Payments Services” product management team guarantees market proximity

- Professional banking service desk is the first point of contact for your queries

Securities Services

We process transactions efficiently and securely

Securities masterfile management

We maintain and enrich securities masterfile data

Capture Services

We digitise all records and documents