The best coverage, reimagined

Household insurance subscription

In cooperation with

![]()

- Take cover out online

- Pay monthly

- Make changes at any time

- Monthly cancellation option

Package

Personal liability

- Bodily injury

Liability for death, injuring or otherwise damaging the health of people.

Learn more - Property damage

Destruction, damage or loss of property, death, injury or loss of animals.

Learn more

Additional options

- Gross negligence

waiverInsurance companies are entitled to reduce benefits if damage was caused by gross negligence. This supplementary insurance also protects you in the event of gross negligence, as the insurance company waives such reductions.

Learn more - Driving third-party

vehiclesDamage that you, as the driver of occasionally borrowed motor vehicles, cause to these vehicles.

Learn more

Household contents

- Fire

Damage to household contents caused by fire, lightning or explosion. Damage through scorching and damage to insured property inadvertently exposed to heat or warmth are also insured.

Learn more - Natural hazards

The insurance covers damage to household contents caused by flood, inundation, storms (winds with a minimum velocity of 75 km/h uprooting trees or taking the roofs off buildings in the vicinity of the insured property), hail, avalanches, snow pressure, rock slides, falling stones and landslides.

Learn more - Theft

Damage to household contents due to burglary, robbery and simple theft. Simple theft is defined as perpetrators sneaking into the home, e.g. through an ajar window, and stealing insured property.

Learn more - Water

The insurance covers damage to household contents caused by liquids leaking from pipes and installations.

Learn more

Additional options

- Accidental damage to

electrical equipmentElectrical appliances belonging to the household contents. In other words, devices that are powered by batteries or sockets, such as cell phones, laptops, televisions or vacuum cleaners.

Learn more - Simple theft outside

the homeItems that you take with you when out and about and that are stolen.

Learn more - Glass breakage

(2 options)Glass furniture

Breakage affecting glazing on furniture or glass tabletops.

All glass

Breakage affecting glass furniture and building glazing as well as glass-like building materials in your home. In addition to glass components in furniture, also breakage affecting washbasins, ceramic cook-tops and, of course, windows.

Learn more - Frozen goods

Damage to your food that you store at home in freezers or freezer compartments if the appliance has failed due to a breakdown of the cooling unit and the food has spoiled.

Learn more

Choose package

Household

S

The no-frills essentials

Personal liability

-

-

Additional options

-

-

Household contents

-

-

-

-

Additional options

-

-

-

-

from 13.90 per month

Birth date: 28.02.06

Start date: 06.01.25

Adress: 8032 Zurich

Buildings: Apartment block with max. 3 residences

Rooms: 1 rented

People: 1 adult

Furnishing standard: Basic

Sum insured: CHF 36,000

Household

M

More cover, fewer headaches

Personal liability

-

-

Additional options

-

-

Household contents

-

-

-

-

Additional options

-

-

-

-

from 30.10 per month

Birth date: 28.02.06

Start date: 06.01.25

Adress: 8032 Zurich

Buildings: Apartment block with max. 3 residences

Rooms: 1 rented

People: 1 adult

Furnishing standard: Basic

Sum insured: CHF 36,000

Household

L

The comprehensive package

Personal liability

-

-

Additional options

-

-

Household contents

-

-

-

-

Additional options

-

-

-

-

from 34.40 per month

Birth date: 28.02.06

Start date: 06.01.25

Adress: 8032 Zurich

Buildings: Apartment block with max. 3 residences

Rooms: 1 rented

People: 1 adult

Furnishing standard: Basic

Sum insured: CHF 36,000

Can’t find the right subscription?

Then tailor-make your own.

Any of the additional options can be added or removed according to your needs.

What does household insurance cover?

Personal liability

Bodily injury

Property damage

Additional options

Gross negligence waiver

Driving third-party vehicles

Household contents

Fire

Natural hazards

Water

Theft

Additional options

Accidental damage to electrical equipment

Simple theft outside the home

Glass breakage (2 options)

Frozen goods

The benefits for you

Take out policy easily online

You can take out the insurance subscription easily online in a few clicks. No paperwork or complicated consultations.

Monthly payments

Your insurance subscriptions can be conveniently paid for through your Swisscom bill as usual, in just the same way as your other Swisscom subscriptions.

Make changes any time

Need to make changes to your insurance cover? Not a problem. You can make changes to your insurance as quickly and easily as you took it out.

Monthly cancellation option

Lengthy contractual terms are a thing of the past. You can cancel your insurance subscriptions at any time to the end of the month, with no ifs or buts.

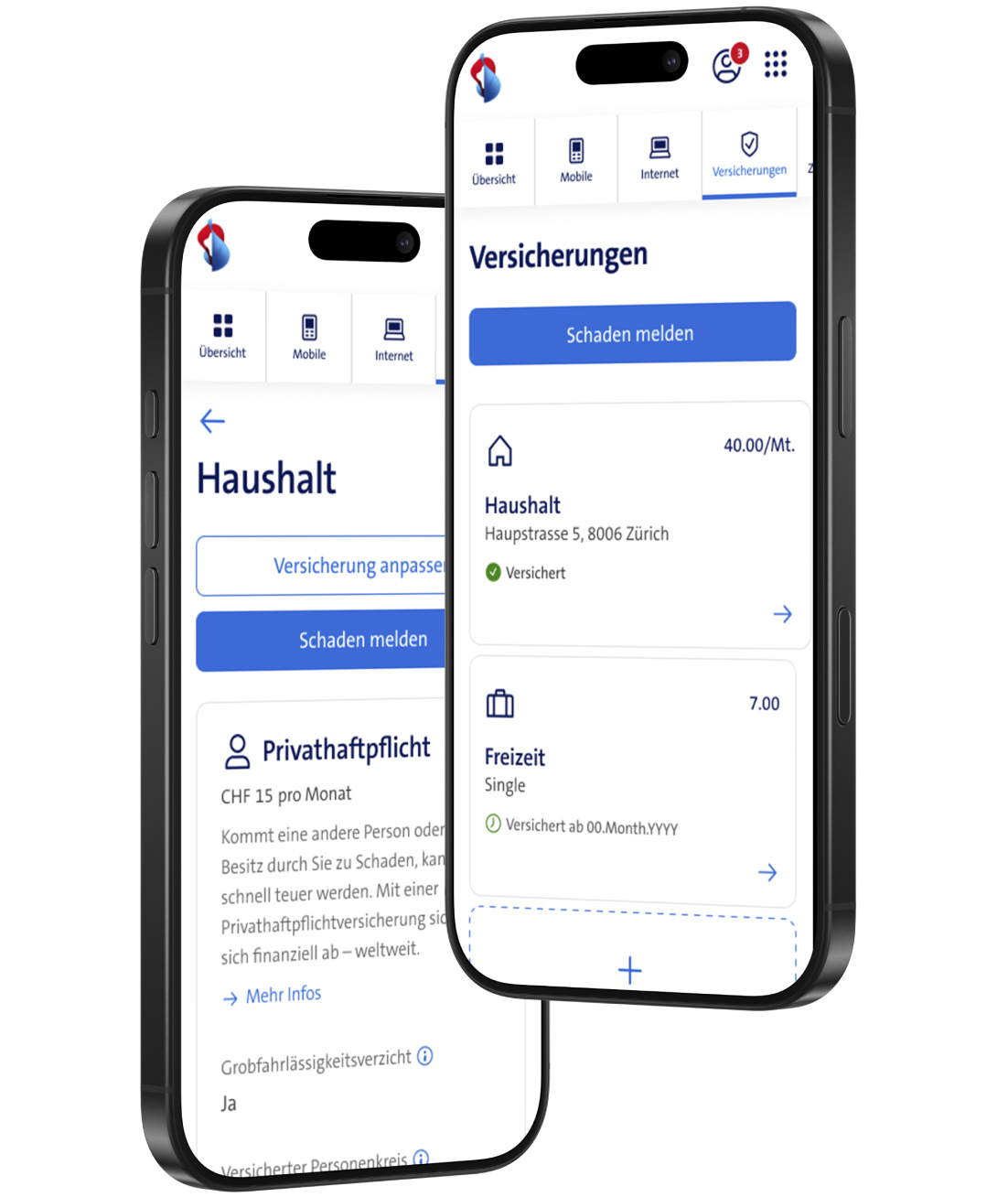

Everything in the My Swisscom app

You will find everything relating to your insurance subscription in the My Swisscom app.

| | Policy, documents, bills |

| | Report claims |

| | Change cover and options |

| |

Cancellation template: We’ll help you switch to us.

FAQs

What is personal liability insurance?

Why do I need personal liability insurance?

Is personal liability insurance compulsory?

Does it make sense to take out personal liability insurance per person or for the entire shared accommodation?

Is damage caused by my pets also covered by personal liability insurance?

Does personal liability insurance apply worldwide?

Does the supplementary insurance also apply to damage caused to third-party motor vehicles abroad?

Why do I need contents insurance?

Is contents insurance compulsory in Switzerland?

What is classed as household contents?

What is the sum insured?

What is a deductible?

We live in shared accommodation – do we each need to arrange contents insurance or can we take it out as a group?

What data does Swisscom use, how and for what purpose?

We would be happy to advise you personally

If you have any questions, please contact the Swisscom sure Customer Care team.

Free: Lines are open Monday to Friday 8 am to 5 pm.

Make a claim

Report claims by telephone. We will redirect your call to the Zurich Insurance Company Ltd.

Free 24/7/365