Johs Höhener has been publishing the Swiss Fintech Start-up Map for the past six years. He is an expert on trends and developments in the fintech industry, which, in his view, will undergo a complete transformation in the next ten years.

The Swiss banking industry will change more significantly in the next ten years than it has done in the past 100 years – accelerated by the emergence of disruptive business models in fintech start-ups. That’s the prediction of Johs Höhener, who published the first Swiss Fintech Start-up Map around six years ago.

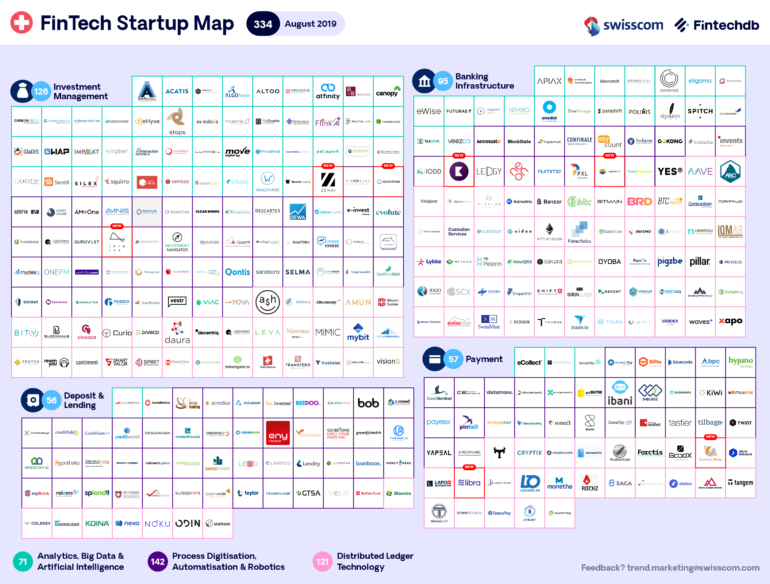

His reason for creating the map? When the hype around the fintech industry first began, he felt there was a lack of transparency about how it was developing and who was active within it. The industry has evolved significantly since then and the newly categorised and digitised Swiss Fintech Start-up Map charts 334 start-ups this August. Here, expert Johs Höhener examines the most exciting features of the Swiss market.

The winners

‘I anticipate a massive increase in the number of fintech start-ups in the area of digital assets, based on new technologies like blockchain or distributed ledger.’

‘In the future, fintech start-ups will focus more on using artificial intelligence in combination with blockchain technology.’

The losers

Johs Höhener, Head of Fintech

Johs Höhener is responsible for the Swisscom Fintech cluster, founded in 2016. Prior to that, in 2012, he established the e-foresight think tank, a new collaboration for cantonal banks in the context of the new digital world, transferring it to Swisscom in 2014. Johs. Höhener has over 25 years’ experience in the banking sector in Switzerland, but also in Ireland, Germany, Austria and Singapore.

Johs Höhener is responsible for the Swisscom Fintech cluster, founded in 2016. Prior to that, in 2012, he established the e-foresight think tank, a new collaboration for cantonal banks in the context of the new digital world, transferring it to Swisscom in 2014. Johs. Höhener has over 25 years’ experience in the banking sector in Switzerland, but also in Ireland, Germany, Austria and Singapore.

‘In the payment sector, it will all be about the big players. It’s not easy to survive in the jungle of the finance industry. The number of fintech start-ups will certainly not increase in this area; a few might even disappear. The payment sector has just been hyped up too much.’

‘The monetisation of data from banks and insurance companies has grown more slowly than I anticipated a few years ago. On our map, we show 20 to 30 start-ups that are actually working on data insights. That is a very small number when you consider the quantity of data that is available in the finance industry.’

Stability of the players

‘If you measure the Swiss fintech market based purely on new arrivals and exits, then it is actually very static. It is astonishing that such a high number of start-ups have managed to survive in the past two years. This can be explained by the fact that seed financing – the initial round of financing for the first one or two years – works exceptionally well in Switzerland.’

Founders’ start-up capital

‘In Switzerland, many fintechs are founded by people who have worked in the finance industry. So they have earned accordingly and usually have a good financial nest egg. This equity allows them to sustain self-financing for a long time in the initial phase.’

Image gallery: The Swiss Fintech Start-up Map from 2013 to today

Growth of fintech start-ups

‘The Swiss fintech start-up scene is in good shape; along with Singapore, we are among the top players in this sector. This is also a true reflection of the finance industry.’

‘The problem in the Swiss market is supplementary funding and the size of the market. When it comes to raising capital to fund growth (series A/B) for things like international expansion, then things get considerably tougher. This is also the reason why there are still no unicorn companies – like the European fintechs N26, Revolut or Transferwise – on the Swiss Fintech Map.’

‘The fintech scene is slowly maturing, but is still heavily influenced by a large number of start-ups that focus on the Swiss market. The Swiss market is very small, production costs are high and unless there is a proactive international strategy, we are unlikely to see Swiss fintech unicorns.’

Relationship with banks

‘Five years ago, it was still the case that fintech start-ups were disrupting the banks. Now, everything is going to change. For the past three years, we have been in a phase of cooperation between start-ups and banks. In the future, it will probably return to being more about competition and disruption.’

‘The Swiss Fintech Map also shows that the banking industry will change more significantly in the next 10 years than it has in the past 100 years. This development will be driven by technology and customer requirements or changes in social values. The need for ownership is diminishing. In the future, who will still want a savings account so they can save up to own their first car?’

About the Swiss Fintech Start-up Map

The map’s design has been updated with the help of Norwegian start-up Fintechdb. Since June, it has been newly divided into four business areas (primary) and three technologies (secondary).

Who is shown on the map? All Swiss fintech start-ups.

I am a fintech start-up and want to be included on the map. What do I do? Send an email to Trend.Marketing@swisscom.com, preferably with a logo and short description.

What are the selection criteria? Swisscom Fintech and the Institute of Financial Services Zug IFZ at the Lucerne University of Applied Sciences and Arts assess each start-up according to the following criteria: the start-up was founded less than 10 years ago, is located in Switzerland, focusses on business model innovations and new technologies in the finance sector and still hasn’t reached its targeted level of maturity.

How is the map kept up to date? As soon as one of the aforementioned criteria changes (too old, no focus on fintech or no longer a start-up), the start-up is removed from the list.