What is the position of Swiss fintech start-ups specialising in digital ledger technology (DLT), or blockchain? We interview two industry experts.

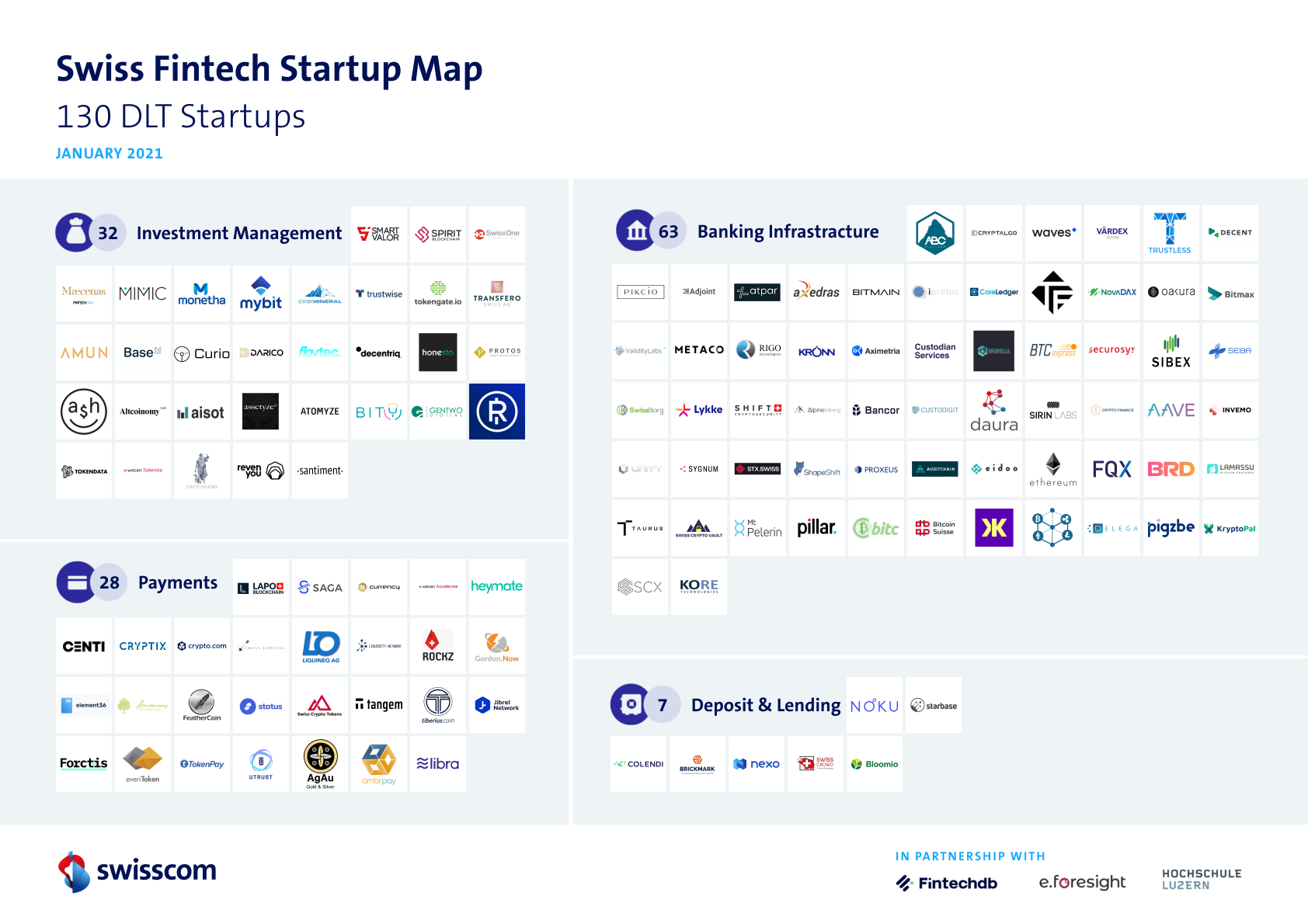

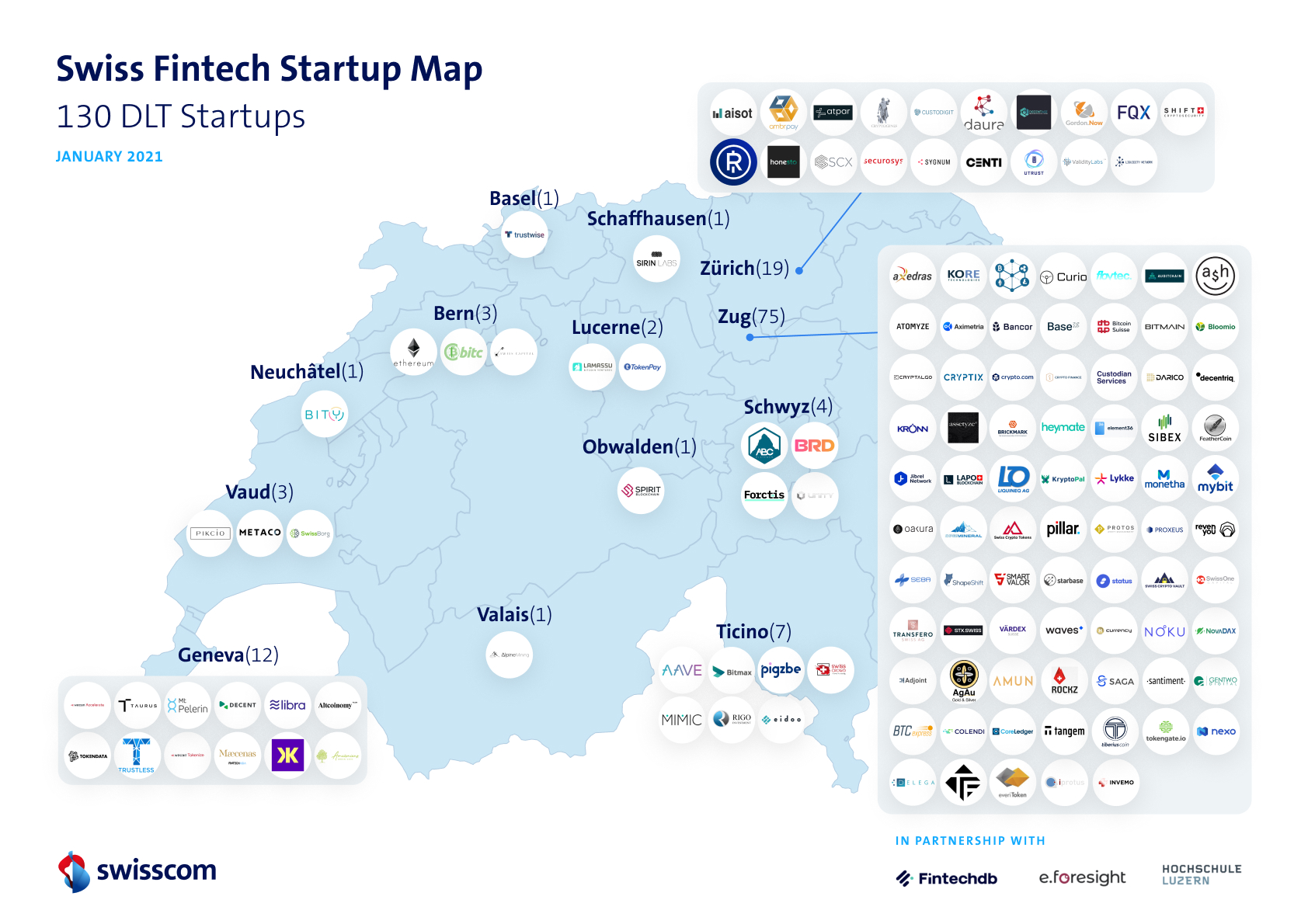

Swisscom has been publishing the Swiss Fintech Start-up Map for seven years. One of the technology clusters is start-ups working on DLT. But how is this technology evolving and are there realistic business applications beyond cryptocurrencies? Thomas Ankenbrand of the Institute of Financial Services Zug (IFZ) at Lucerne University of Applied Sciences and Arts and Roland Cortivo of Swisscom address these questions.

How has the DLT fintech start-up landscape changed in recent years?

Thomas: The first DLT fintech start-ups were founded before 2017. At the time, we had around 20 start-ups registered. There was a significant uptick in 2017/18 with around 80 DLT start-ups on the fintech map by then. More than half of all fintech companies founded in 2017 were from the blockchain and crypto scene. Over the last two years, the growth of new DLT start-ups has stagnated and it will be interesting to see how the situation pans out in 2021, especially in light of the current boom in cryptocurrencies, which was also a significant factor in the 2017 increase.

A revised blockchain act is due to come into force this year. Is this likely to have an impact on DLT start-ups?

Roland: It is unusual to see a parliamentary bill passed unanimously and implemented as quickly as this. With effect from 1 February 2021, the Federal Council has brought those parts of the DLT bill into force that enable ledger-based securities to be introduced. As a new licence category, DLT trading facilities will also offer simplified administration and new opportunities. Financial services providers and fintech start-ups will therefore be forced to act if they do not want to leave this field. Against this backdrop, I expect that we will see a further growth of innovative fintech and blockchain businesses.

How do you assess the distribution of start-ups across the four business areas?

Thomas: The low number of start-ups in the ‘Deposit and Lending’ business area is very striking. The impact of Decentralised Finance (DeFi) in this area could lead to growth. Examples include Compound Labs and the Swiss equivalent, Aave, which facilitate the lending and depositing of digital assets with corresponding rates of interest.

Roland: The largest business area, ‘Banking Infrastructure’, is a real mixed bag, covering tokenisation (Axedras, daura), custody services (Taurus, Custodigit) and crypto banks (Seba, Sygnum). I expect that this business area will enjoy continued growth, including in bank-related services such as multi-bank signature management (Delega).

To what extent is Switzerland an attractive location for DLT start-ups?

Thomas: There is a variety of reasons that make Switzerland a great location for fintech start-ups, including the stable political situation and the strength of the Swiss financial market. Our study, ‘FinTech Study 2020, an Overview of Swiss FinTech’, demonstrates that Switzerland is very well placed in respect of all the key indicators, with only Singapore ranked more highly than Zurich and Geneva. However, we have to leverage this locational advantage as the competition will be raring to go.

‘One in six blockchain start-up earns its money in the finance industry.’

Roland Cortivo

Thomas, you mentioned that the number of new DLT start-ups has stagnated over recent years. What exactly does that mean?

That’s right, but existing start-ups have evolved and developed their professionalism over that period. The number of employees has increased. And the capitalisation of companies demonstrates that the sector has matured and stabilised. I cannot detect any signs of consolidation at present. M&A transactions and company closures have so far been few and far between.

Are there any start-ups on the map that you would like to highlight in particular?

Thomas: Yes, there are a few great examples I could mention. One I’d like to highlight is Ethereum: It currently sits in second place when it comes to market capitalisation, just behind Bitcoin, but offers much more functionality. A large number of apps are being built on the Ethereum blockchain. In many sectors, it is pretty much the standard. It is also a nucleus of Crypto Valley.

Roland: Bitcoin Suisse has an impressive track record. In December 2020, against the backdrop of buoyant markets and Bitcoin’s year-end rally, the leading force in crypto financial services registered significant growth in new customer contacts and an almost doubling of trading volume compared to October. This came on the back of a strong performance already recorded for the first three quarters.

Roland, how do you view the development of fintech blockchain companies compared with blockchain companies from other sectors?

In the first half of 2020, CV VC (Crypto Valley Venture Capital) accounted for 835 of Switzerland’s blockchain companies. In other words, one in six blockchain companies earns its money in the finance industry.

In 2021, we will see more sustainable finance initiatives, such as efforts to increase the transparency of eco-friendly ESG funds or those to prevent double spending in CO2 certificates. One of the benefits of blockchain is that it overcomes the trust gap. As this is not a huge factor in the financial sector, we will see stronger growth in other industries including pharmaceuticals and logistics.

DLT and fintech trends

In the short term, in order to facilitate further development, it is vital that digital assets become widely accepted in the institutional investment world. We are seeing the first signs of this, with crypto banks such as Sygnum bridging the gap between the world of digital assets and traditional banking.

In the medium term, we need to keep our eye on the activities of the central banks. For the first time, these operators are now emerging as the drivers of innovation and no longer simply as regulators, due to the challenges inherent in tackling the coronavirus crisis. In Switzerland, an example of this is the ‘wholesale CBDC’ experiment by BIS, SNB and SIX.

In the long term, the question will be whether to move the entire monetary system to DLT. While consumers would hardly even notice a switch of this type, there would be major repercussions for conventional banking, calling into question its current role and position. However, this is a matter of economic policy rather than technology.

Matthias Niklowitz, Think Tank e.foresight

Thomas, what developments do you see in DLT fintech start-ups?

Blockchain technology facilitates the merging of private market assets and listed capital investment, creating new business models. The collaboration between daura and SIX Digital Exchange (SDX) is a good example of this. daura offers non-listed companies a platform for a digital ledger and the issuance of securities tokens. A newly created share is represented by a digital token. SDX is being set up as a fully integrated financial market infrastructure for digital assets, which allows companies to issue digital securities tokens.

Successful blockchain-based business models continue to be rare. Is blockchain technology breaking through here in Switzerland?

Roland: The breakthrough will come when people no longer talk about blockchain; or rather, when the benefits of the technology are utilised in the background: if I can use a digital currency to buy green bonds in real time or share my employer reference and vaccination certificates in my digital wallet, for instance.

The hype surrounding blockchain technology has given rise to over-optimistic expectations here in Switzerland too. Companies are now aware of the technology and consider it realistic for specific business cases. The financial sector is at the forefront of this. The benefits offered by blockchain, such as cost effectiveness, security and transparency, support its use. However, a few issues remain to be resolved before it is adopted more widely, including interoperability, standardisation, scalability and energy consumption.

Thomas: Blockchain will not revolutionise the world, but DLT will improve many things and will definitely find its place. The advantages of the technology can be leveraged wherever databases and cashflows are connected. I see great opportunities in data markets such as the health sector for managing and processing my health data. An important aspect here is that each individual has control over the data and how it is used.

Roland Cortivo

has in-depth knowledge of the Swiss blockchain and fintech scene and digitises the market for businesses: As Head of Blockchain Infrastructure for Digital Business at Swisscom Ltd, he collaborates with start-ups and financial services providers to promote new business models and technologies. He co-founded the start-up daura for tokenised assets and is developing Switzerland’s distributed DLT infrastructure for enterprise blockchain applications.

Thomas Ankenbrand

is working in the Investment Management and FinTech department at the Institute of Financial Services Zug (IFZ) at Lucerne University of Applied Sciences and Arts since 2015. He is also the founder and chairman of several companies in the financial sector.