Today’s insurance companies process large amounts of private and sensitive information, and must ensure the integrity, quality and security of this data at all times. Data governance is a management function that involves establishing a strategic framework for the effective and responsible use of data.

With data governance, insurance companies establish the fundamentals underpinning their data management and usage practices. This serves as the foundation for their compliance with regulatory requirements and forms the basis for reliable, consistent business decisions. It also strengthens the trust of customers and other stakeholders in these organisations.

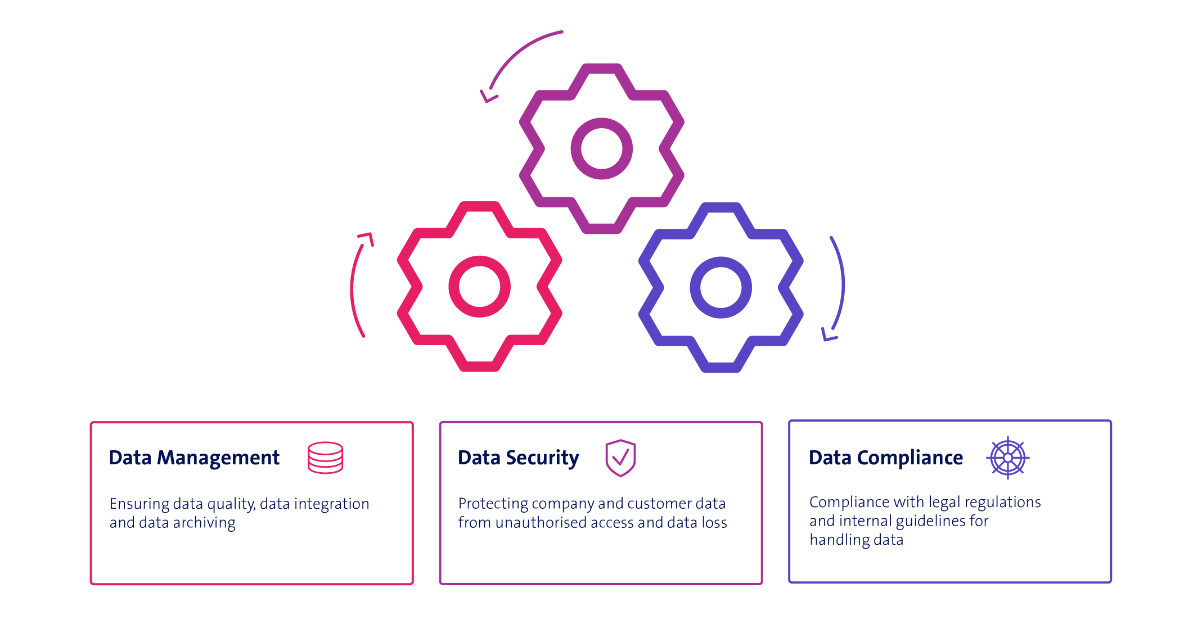

A data governance framework is a set of policies, standards, processes and roles that guarantees high data quality. At the same time, it ensures that data is handled in accordance with the law and is stored reliably. A robust data governance framework includes:

- Organisation: Structuring of data streams, roles and responsibilities

- Technology: Use of appropriate tools and platforms

- Architecture: Consistent and secure data processing

- Policies: Data handling codes of practice

- Processes: Data generation, processing and deletion workflows

- Compliance: Compliance with legal requirements and monitoring of data processing

Benefits of data governance in day-to-day insurance operations

Insurance companies in Switzerland are highly dependent on data and regulations. The following examples illustrate the importance of data governance as a basis for business management for insurers today and show the main reasons why it is crucial:

- Regulatory compliance: Insurers must comply with strict legal requirements. Effective data governance helps them to meet these requirements by ensuring that data is managed in a legally compliant and secure manner.

Example: A leading insurance company implemented a data governance framework to ensure compliance with data protection regulations and significantly reduced compliance violations. - Improved decision-making: Insurers can make better decisions with a uniform and consistent data pool. High-quality data allows for more precise risk assessments and well-founded premium calculations.

Example: One insurer was able to increase the accuracy of its risk models by 20% and offer more competitive premiums. - Cost savings and efficiency: Data governance reduces redundancies and inconsistencies, leading to cost savings and more efficient data processes.

Example: One company reduced operating costs by 15% by centralising data management. - Increased data security and protection: A robust data governance framework protects sensitive customer data from loss and unauthorised access, which strengthens customer trust.

Example: After implementing strict guidelines, one insurer was able to reduce data breaches by 30%. - Optimised customer interactions: High-quality, up-to-date data enables personalised customer interactions and improves the customer experience.

Example: Consolidated customer data enabled one insurer to conduct personalised marketing campaigns and increase the conversion rate by 25%. - Support through artificial intelligence (AI): Generative AI’s large language models offer enormous potential for automating and improving customer interactions and for risk assessments. Solid data governance ensures that AI systems work with high-quality data to deliver reliable results.

Example: One insurer integrated AI-supported chatbots for customer support, which led to faster and more accurate responses and significantly increased customer satisfaction.

What are the best practices for implementation?

Market observation and experience show that these approaches are particularly promising and purposeful when establishing data governance in insurance companies:

- Centralised data management: Implement a centralised system to manage all relevant data for consistency and ease of access.

- Transparent processes: As a committee, establish clear guidelines and procedures for data classification, quality, security and access and monitor compliance.

- Technology investments: Use modern data governance tools to support data quality checks and automated data cleansing.

- Training and awareness-raising: Ensure regular employee training in data governance and compliance requirements.

- Continuous monitoring and adjustment: Use KPIs to measure the success of your data governance programme and regularly adapt policies to new requirements.

Use data as a strategic resource and expand your competitive advantage

For insurers who want a solid foundation for better data quality, more efficient processes and stronger customer loyalty for their organisation, we recommend talking to our team of experts to analyse the current situation and discuss possible ways forward.

Would you like more information? The Swisscom Data & AI Consulting team would be happy to help you with your data governance project.